[ad_1]

The article under is from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Disinflation And Financial Coverage

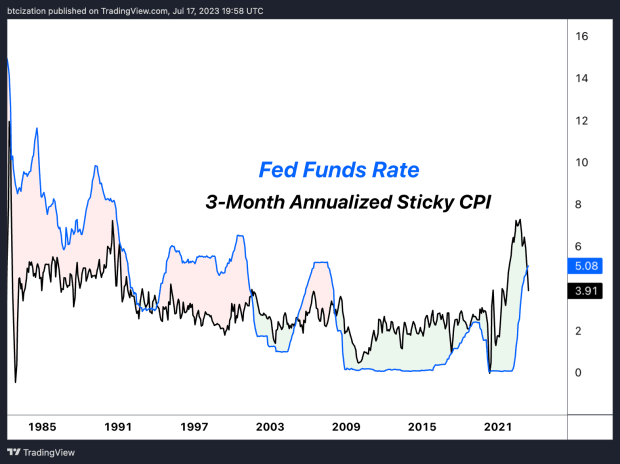

As we delve deeper into 2023, the U.S. economic system finds itself at a crossroads. Disinflation appears to be setting in as a direct results of the Federal Reserve’s tightening financial insurance policies. This coverage shift has led to a notable slowdown within the annualized sticky Client Worth Index (CPI) over latest months. With this in view, the dialog amongst market members has step by step shifted away from inflationary issues and towards making an attempt to grasp the impression of the tightest financial coverage in a decade and a half.

The excessive inflation we’ve skilled, notably within the core basket (excluding meals and vitality), hid the consequences of the swiftest tightening cycle in historical past. Inflation was partially fueled by a decent labor market resulting in elevated wages, and leading to a sustained second-half inflationary impulse pushed extra by wages than by vitality prices.

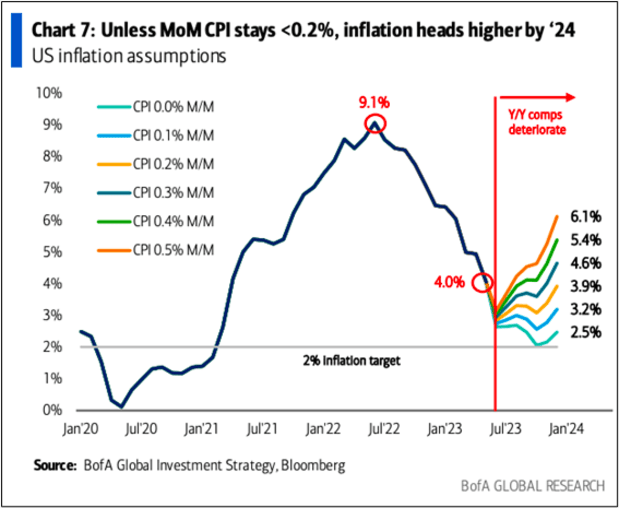

It’s price noting that the bottom results for year-over-year inflation readings are peaking this month. This might result in a reacceleration of inflationary readings on a year-over-year foundation if wage inflation stays sticky or if vitality costs resurge.

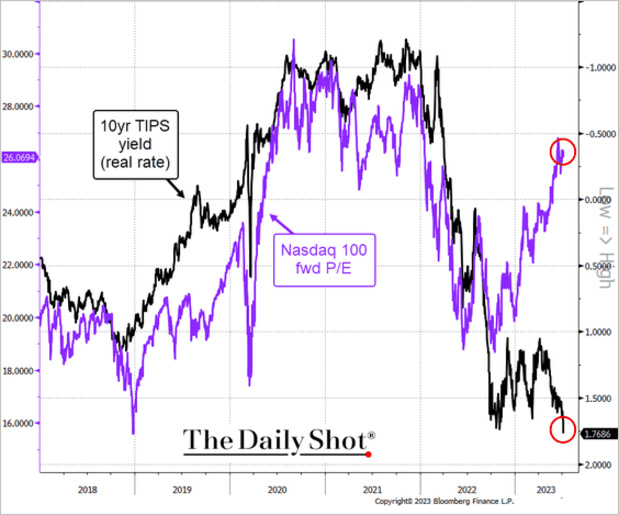

Apparently, actual yields — calculated with each trailing 12-month inflation and ahead expectations — are at their highest in a long time. The modern financial panorama is notably totally different from the Nineteen Eighties, and present debt ranges can’t maintain optimistic actual yields for prolonged durations with out resulting in deterioration and potential default.

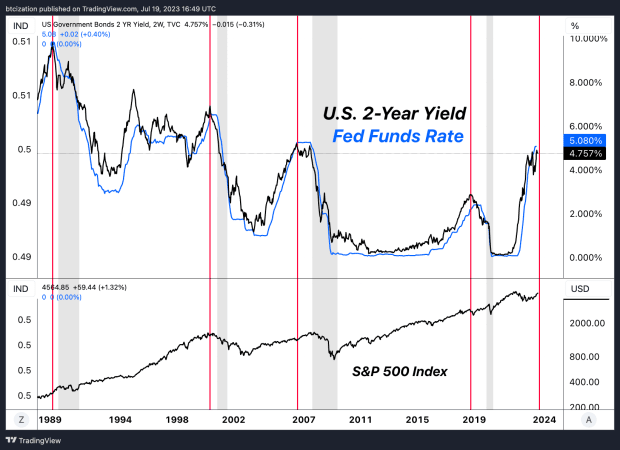

Traditionally, main shifts out there happen throughout Fed tightening and slicing cycles. These shifts typically result in misery in fairness markets after the Fed initiates price cuts. This isn’t intentional, however fairly the unwanted side effects from tight financial coverage. Analyzing historic traits can present worthwhile insights into potential market actions, particularly the two-year yields as a proxy for the common of the following two years of Fed Funds.

Bonds And Equities: The Rising Disconnect

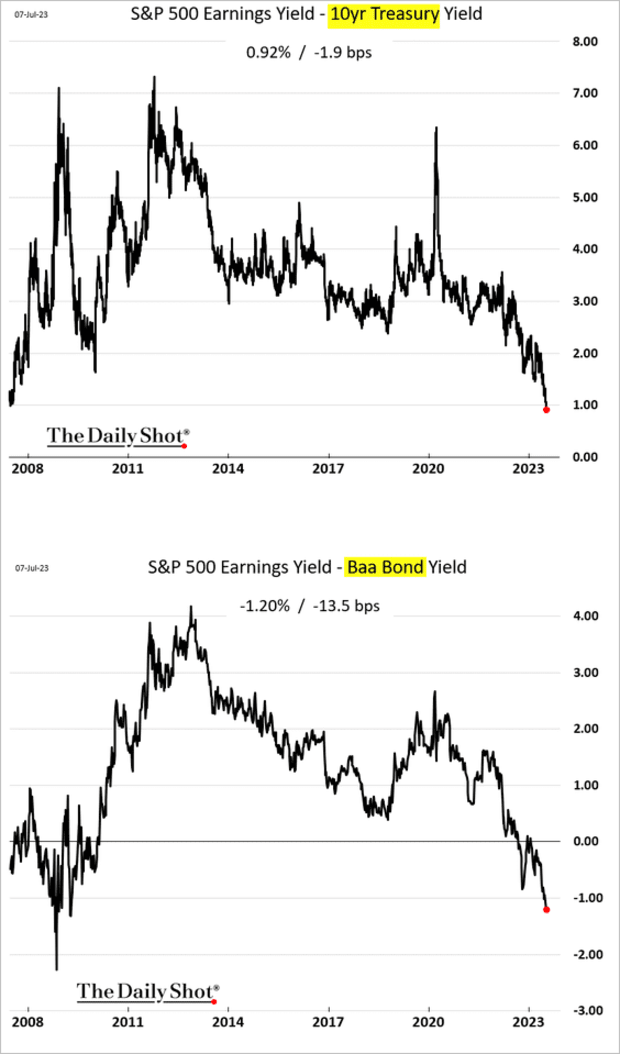

At the moment, there’s a large and rising disconnect between bond and fairness markets. It’s common for fairness earnings to outperform bonds throughout an inflationary regime on account of equities’ superior pricing energy. Nevertheless, with disinflation in movement, the rising divergence between fairness multiples and actual yields turns into a crucial concern. This divergence may also be noticed by way of the fairness danger premium — fairness yields minus bond yields.

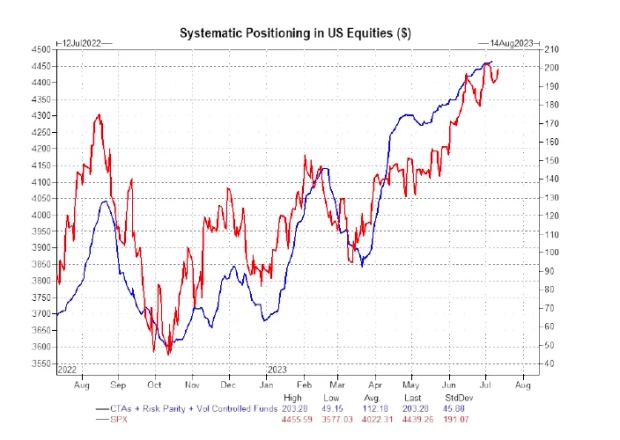

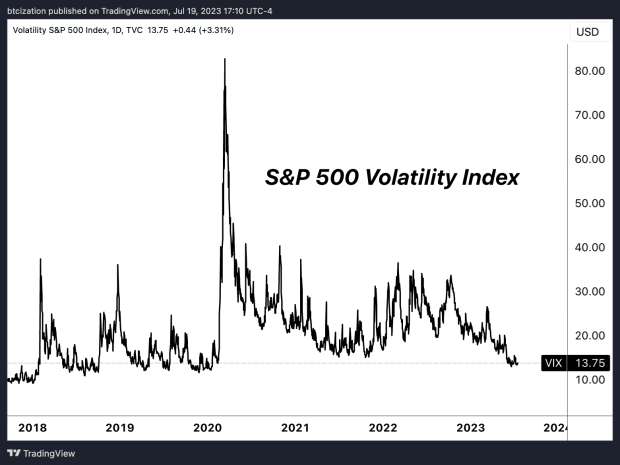

Analysis from Goldman Sachs exhibits systematic funding methods, specifically Commodity Buying and selling Advisors (CTA), volatility management and risk-parity methods, have been more and more utilizing leverage to amplify their funding publicity. This ramp-up in leveraging has are available tandem with a optimistic efficiency in fairness indices, which might be compelled to unwind throughout any strikes to the draw back and/or spikes in volatility.

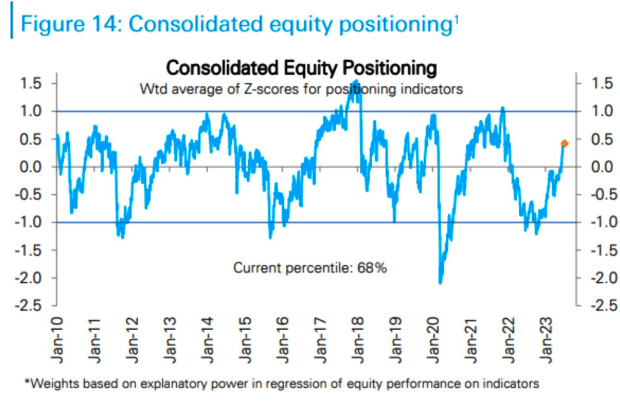

Analysis from JPMorgan Chase exhibits their consolidated fairness positioning indicator is within the 68th percentile, which means equities are overheated, however continuation increased is feasible in comparison with historic requirements.

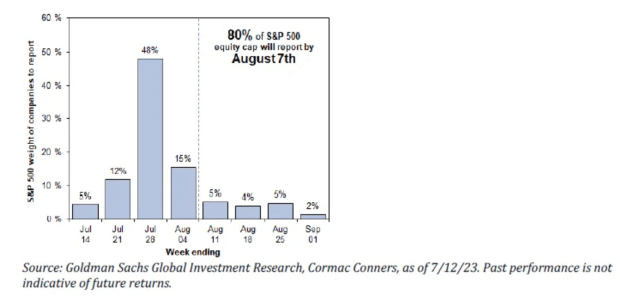

The destiny of fairness markets within the short-to-medium time period will probably be decided by earnings, with 80% of S&P 500 firms set to finish their reporting by August 7.

Any disappointment throughout earnings season may result in a reversion in fairness valuations relative to the bond market.

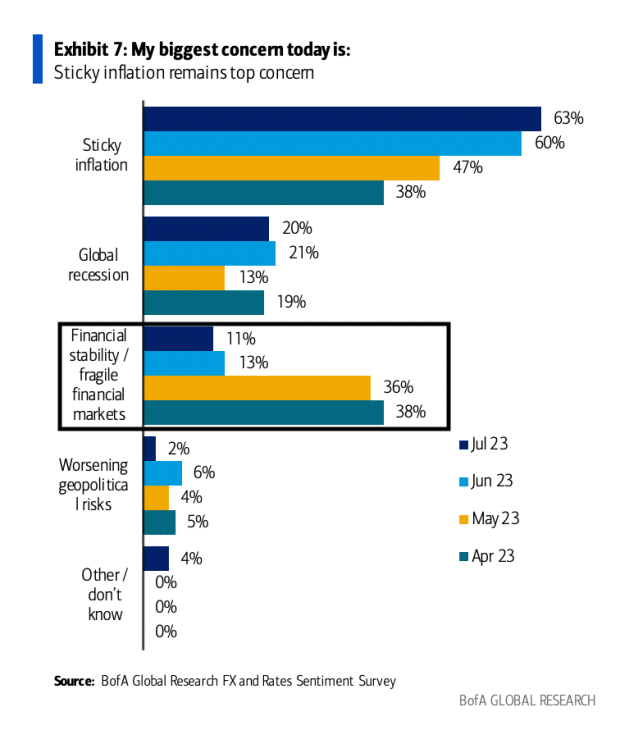

One other fascinating be aware is from a latest Financial institution of America survey, the place shopper concern across the well being of economic markets has risen in latest months similtaneously fairness markets proceed their uptrend.

Headwinds Forward For The U.S. Client?

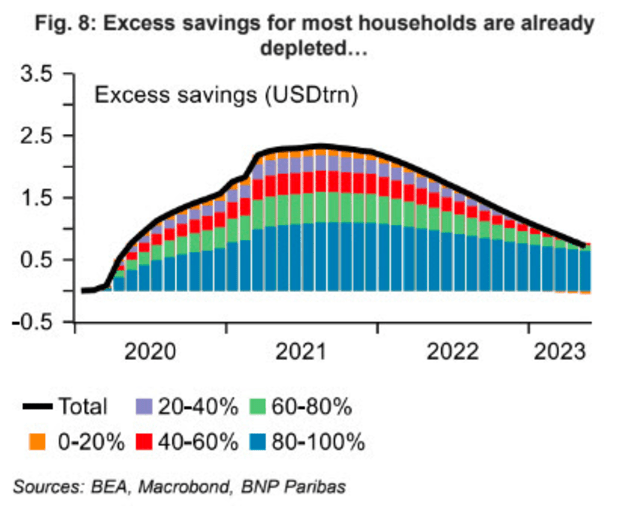

The strong earnings surprises and the U.S. client market’s resilience are being underpinned partially by extra financial savings from the COVID-era fiscal stimulus. Nevertheless, it’s price noting that these financial savings usually are not uniformly distributed. A latest BNP Paribas report estimates that the highest revenue quintile holds simply over 80% of the surplus financial savings. The financial savings of the lower-income quintiles are already spent, with the center quintile doubtless following go well with quickly. With elements just like the resumption of pupil debt obligations and rising weaknesses within the labor market, we must always brace ourselves for potential stress in client markets.

Regardless of potential client market stressors, the efficiency of the U.S. economic system in 2023 has surpassed expectations. Fairness markets have placed on a stellar present, with the bull market showing unrelenting. Amidst these market celebrations, we should preserve a balanced perspective, understanding that the trail ahead will not be as clear reduce or easy because it seems.

Remaining Be aware

We spotlight developments in fairness and rate of interest situations as we discover it essential to acknowledge the rising liquidity interaction between bitcoin and conventional asset markets. To place it plainly:

It indicators substantial demand when the world’s largest asset managers are competing to launch a monetary product that provides their shoppers publicity to bitcoin. These future inflows into bitcoin, predominantly from these at present invested in non-bitcoin property, will inevitably intertwine bitcoin extra intently with the risk-on/risk-off flows of world markets. This isn’t a detrimental improvement; quite the opposite, it’s a development to be embraced. We count on bitcoin’s correlation to risk-on property within the conventional monetary markets to extend, whereas outperforming to the upside and in a risk-adjusted method over an extended time-frame.

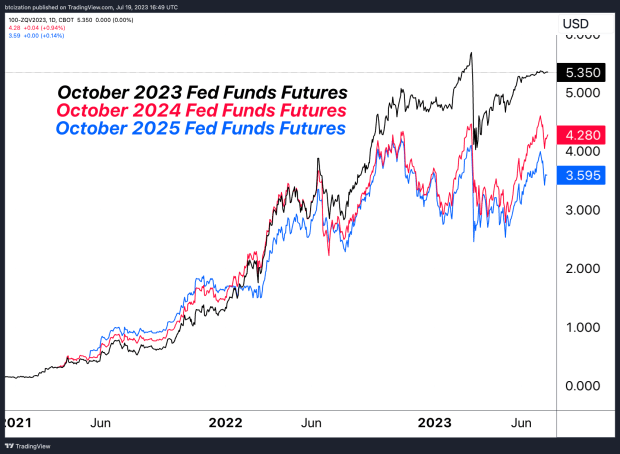

With that being mentioned, turning again to the principle content material of the article, the historic precedent of great lag in financial coverage, mixed with the present situations within the rate of interest and fairness markets does warrant some warning. Conventionally, fairness markets decline and a technical recession happens in the USA after the Fed begins to chop rates of interest from the terminal degree of the tightening cycle. We haven’t reached this situation but. Due to this fact, despite the fact that we’re extraordinarily optimistic concerning the native supply-side situations for bitcoin immediately, we stay alert to all potentialities. For that reason, we stay open to the thought of potential downward strain from legacy markets between now and mid-2024, a interval marked by key occasions such because the Bitcoin halving and doable approval of a spot bitcoin ETF.

That concludes the excerpt from a latest version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles immediately in your inbox.

[ad_2]

Source link