[ad_1]

The co-founder and CEO of analytics platform CryptoQuant, Ki Younger Ju, is analyzing Bitcoin (BTC) because the flagship crypto asset hovers practically 10% under the 2023 excessive.

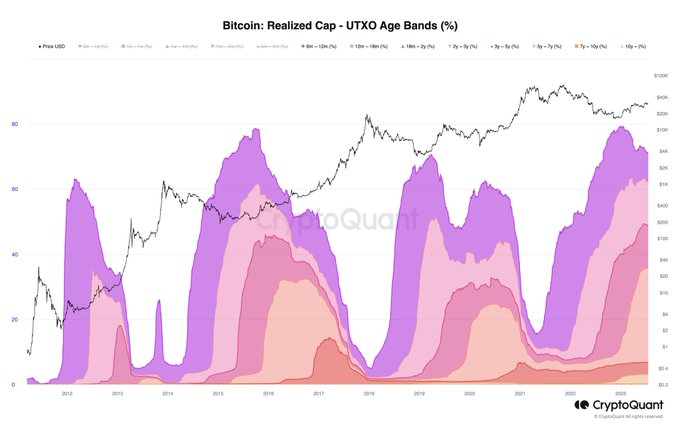

Ki Younger Ju says that Bitcoin continues to be in a bull cycle as a result of low promoting strain being witnessed because of the vast majority of the BTC acquired or mined greater than six months in the past remaining static.

“Bitcoin continues to be in a bull cycle.

Roughly 71% of realized cap is unmoved BTC (better than 6 months), indicating low promoting strain from long-term holders at present.”

Bitcoin is buying and selling at $29,178 at time of writing, about 8.3% decrease than the 2023 excessive of $31,806.

The CryptoQuant CEO, nonetheless, says {that a} value rally will not be assured for the main digital asset.

“Decrease promoting strain doesn’t assure a value improve, however it’s much less doubtless BTC is within the cyclic prime at the very least.”

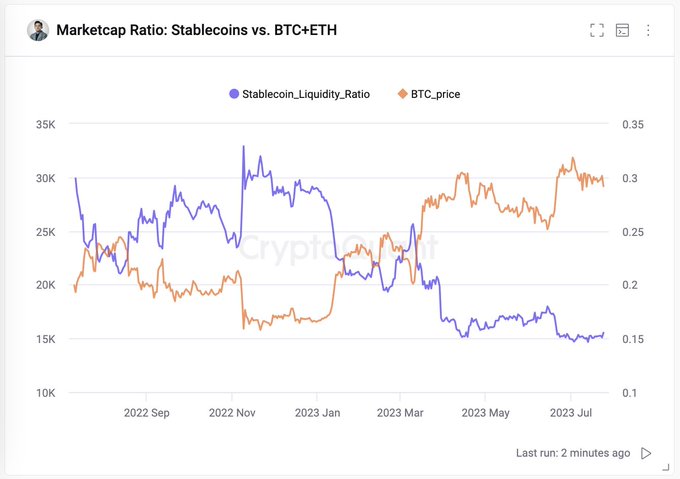

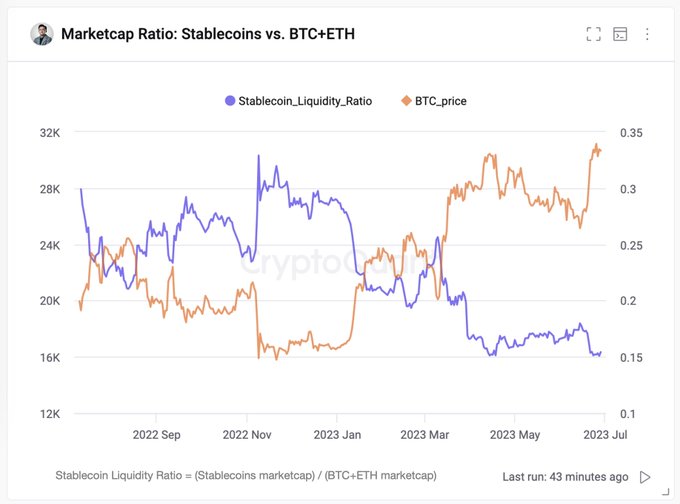

Noting that “Stablecoins for BTC are a superb factor. Folks purchase BTC utilizing stablecoins”, Ki Younger Ju says that the crypto market is more likely to stay calm till the provision of stablecoins rises.

“Market boring till extra stablecoins injected for buy-side liquidity.”

Final month, Ki Younger Ju said that the extent of stablecoin provide was low.

“Stablecoin gas is working low.”

On the time, the CryptoQuant CEO said that the dominance of the Tether (USDT) stablecoin was rising.

“In the meantime, USDT is consuming the stablecoin market.”

The market cap of USDT is at present $83.8 billion whereas that of its closest rival, USD Coin (USDC) sits at $26.6 billion.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Price Action

Comply with us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney

[ad_2]

Source link