[ad_1]

The Bitcoin worth has fallen to the decrease finish of its nearly one-month buying and selling vary between $29,800 and $31,300. Already yesterday, BTC briefly fell to as little as $29,704, solely to get better to $30,306 inside just a few hours. At press time, BTC was once more transferring in direction of the $30,000 mark, and one other fall and liquidity seize appears possible.

Whereas this week the macro knowledge releases are fairly quiet, it’s price having a look at what’s taking place within the Bitcoin market itself.

Why Is Bitcoin Down As we speak?

Swissblock Insights observed a peculiar calm available in the market when Bitcoin reached a brand new yearly excessive of $31.840 final week. Nevertheless, the momentum rapidly pale, and promoting strain elevated, inflicting BTC to drop to the low $30ks. They spotlight the slender Bollinger Bands, stating, “The Bollinger Bands are very slender, with solely a 4.2% worth distinction separating the higher and decrease bands. A transfer is brewing.”

Furthermore, the analysts emphasize the necessity for a major catalyst to inject life into the present lackluster state of affairs:

Volatility is anticipated to look on the scene, though, within the quick time period, we’re in no man’s land; liquidity stays low, open curiosity remains to be flat and shorts are nowhere to be seen. There’s no command within the path we’re going, and solely a major catalyst can spice issues up on this uninteresting state of affairs we’re in.

Based on the analysts, a breakdown of the $29.650 help degree would invalidate a protracted setup. However, a bullish leg up $31.500 might reignite momentum and surge the worth to $33,000. However for this to occur, spot demand must reignite strongly and longs have to enter the market, “in any other case momentum will proceed to fading.”

Glassnode, an on-chain knowledge supplier, additional illuminates the present state of the Bitcoin market. Regardless of the short-term yearly excessive, they describe the market as “extraordinarily quiet”, additionally pointing to the Bollinger Bands. This compression in volatility alerts a market harking back to the calm noticed in early January, as NewsBTC reported yesterday.

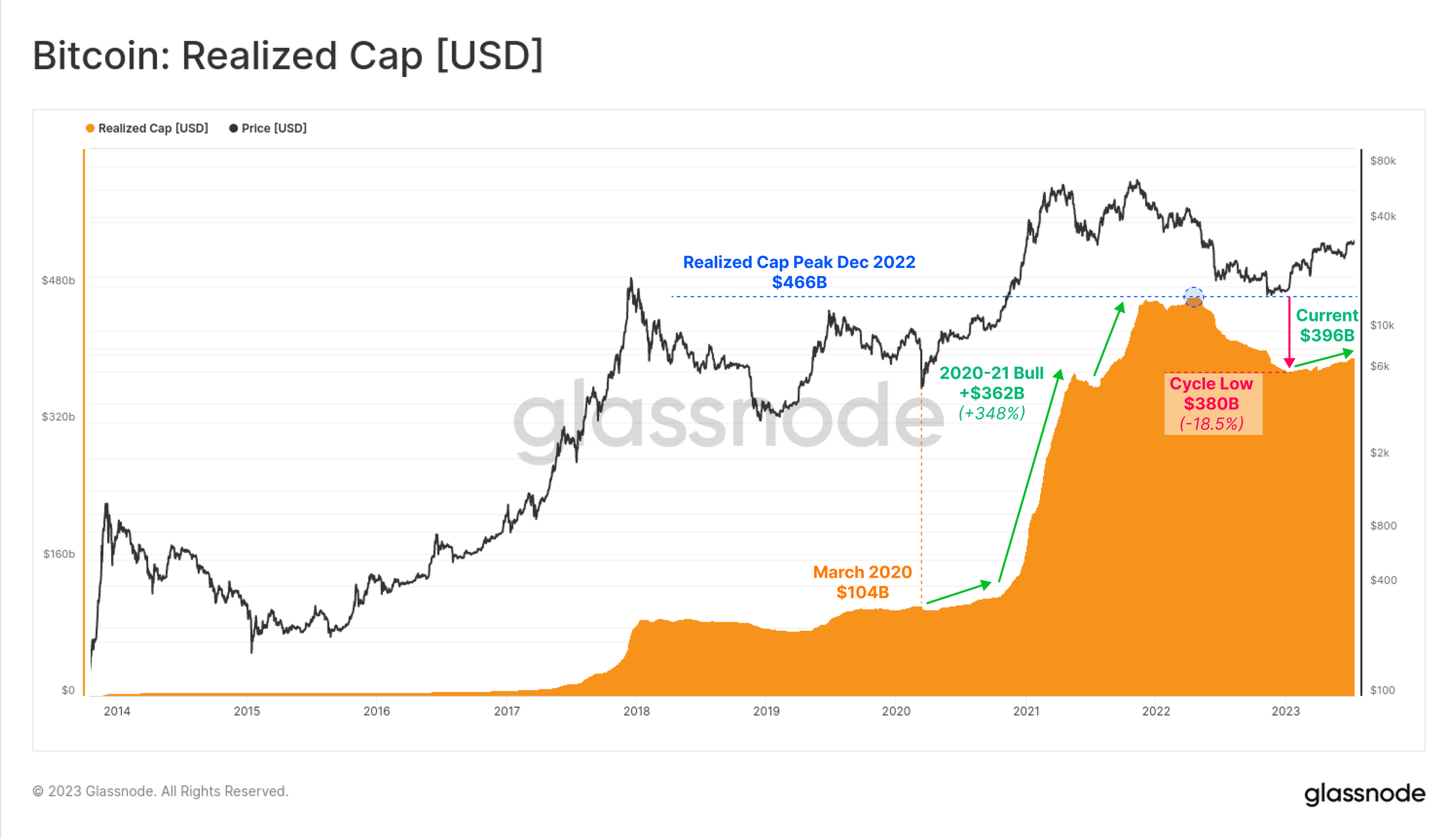

Moreover, Glassnode’s evaluation reveals a gradual however regular influx of capital into Bitcoin. The Realized Cap at the moment sits simply shy at $396 billion. After hitting a cycle low at $380 billion, the metric signifies {that a} gradual however regular stream of capital is getting into the market all through 2023.

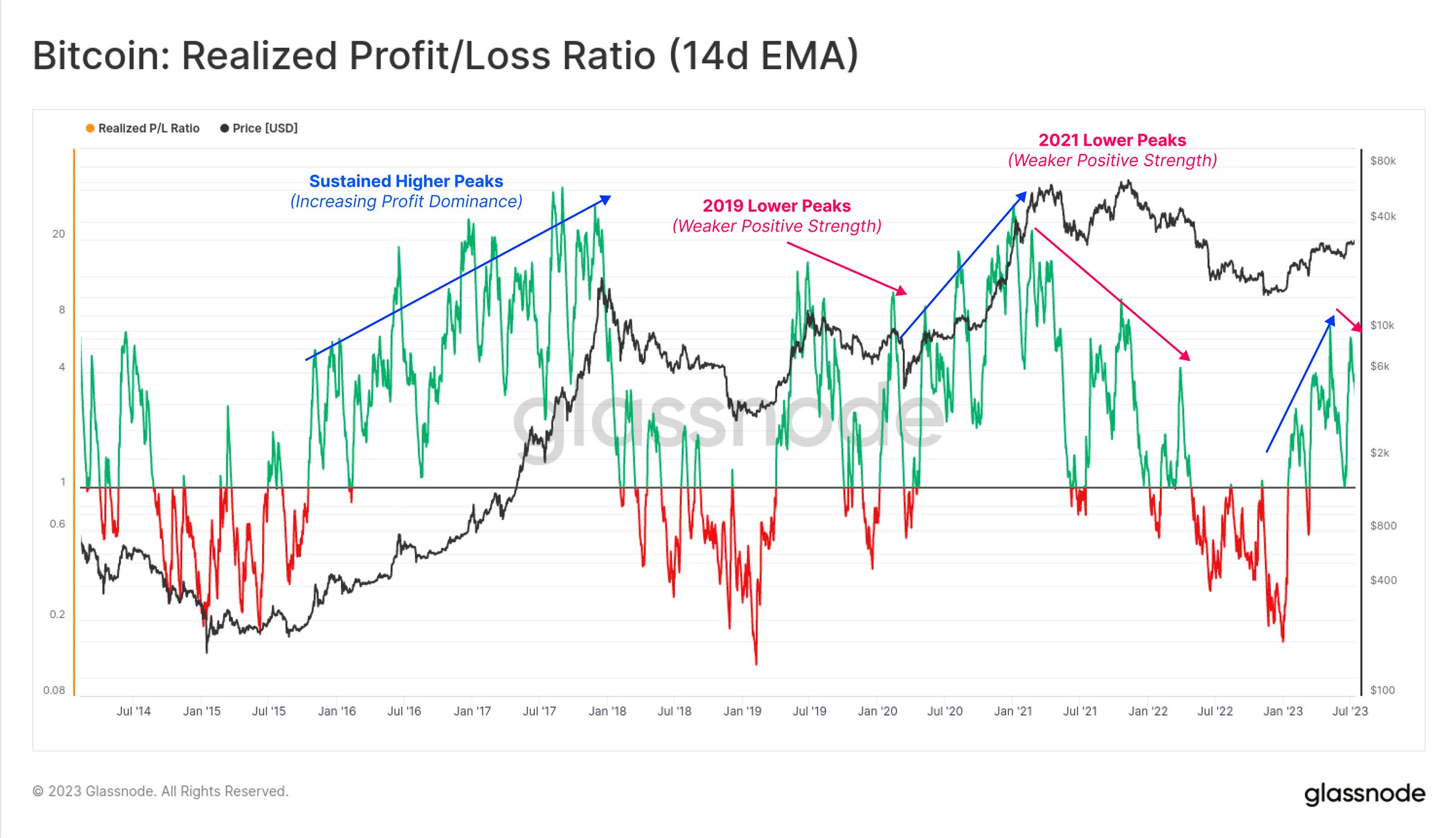

Glasnode additionally emphasizes that traders stay unwilling to half with their held provide, leading to uneven market circumstances just like these seen in 2016 and 2019-20 durations. Complete realized revenue and loss resembles the historic pattern:

If we take a ratio between whole realized revenue and loss, […] we will additionally be aware {that a} decrease excessive on this ratio was set this week. If sustained, it might allude to comparable uneven market circumstances seen in each 2019-20, and once more within the second half of 2021.

The evaluation additionally highlights the profit-locking conduct amongst Bitcoin holders, with nearly all of each short-term (88%) and long-term holders’ balances (73%) held in revenue. Nevertheless, short-term holders are the first entities which can be energetic available in the market.

Out of the overall 39.600 BTC in day by day alternate inflows, 78% of that is related to the STH cohort. Because of this quick time period holders could should trim their earnings in the intervening time earlier than promoting strain eases and the bulls can take the higher hand once more.

GreekLive, an choices skilled, explains that the Bitcoin market remains to be shedding liquidity, which makes it extremely inclined to spikes and V-shaped recoveries:

Cryptocurrencies encountered a V-shaped market right now, with BTC falling beneath $29,700 and ETH beneath $1,875, earlier than rebounding in a V-shaped throughout Asian buying and selling hours to regain the spherical variety of factors, however the choices market barely reacted to this.

The evaluation advises sellers to deal with static safety and have threat management plans for holding choices till expiration. For consumers, well timed profit-taking and utilizing futures to hedge choices are really useful threat administration methods.

At press time, BTC traded at $30,064.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link