[ad_1]

Bitcoin (BTC) miners bought a major quantity of their mined Bitcoin in June to fund their operations, based on Glassnode knowledge analyzed by CryptoSlate.

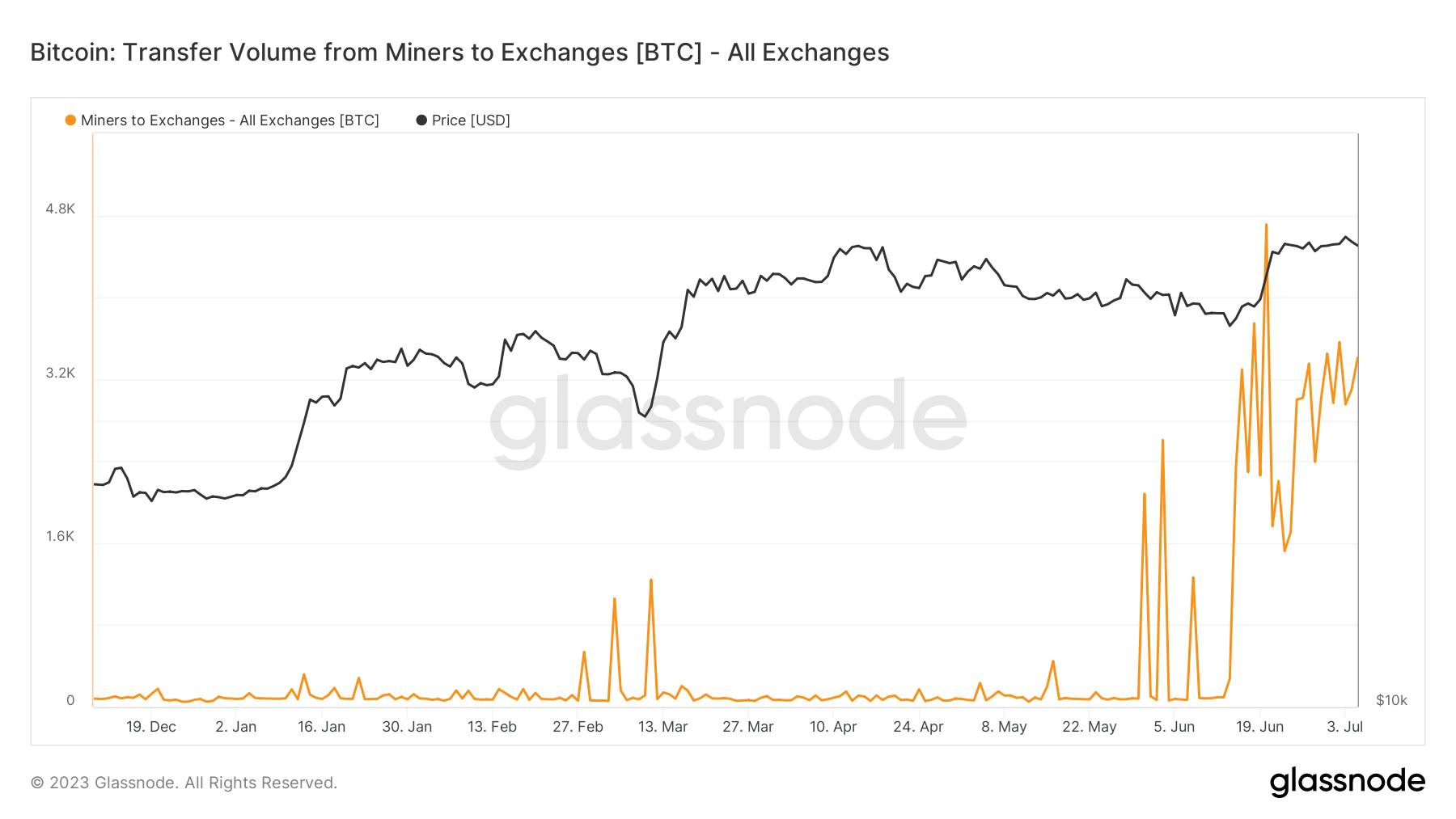

Based on the chart under, miners’ change stream peaked at 4,710 BTC on June 20—the best fee of the previous 5 years. Different days of the month additionally noticed important spikes, averaging over 2000 BTC to exchanges.

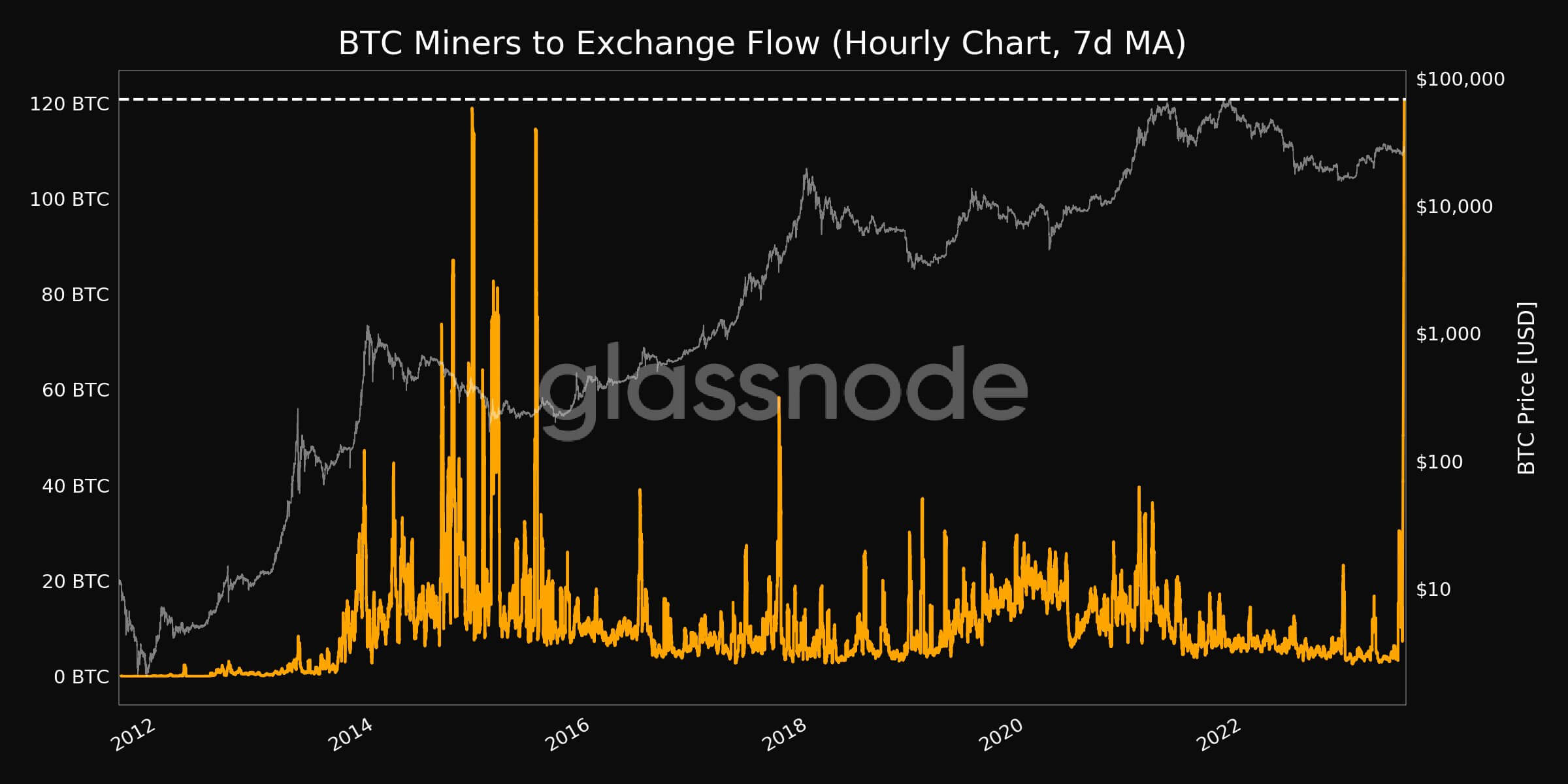

Glassnode stated that the seven days shifting common hourly stream from miners to exchange reached as excessive as 120.77 BTC, one of many highest ranges since 2015.

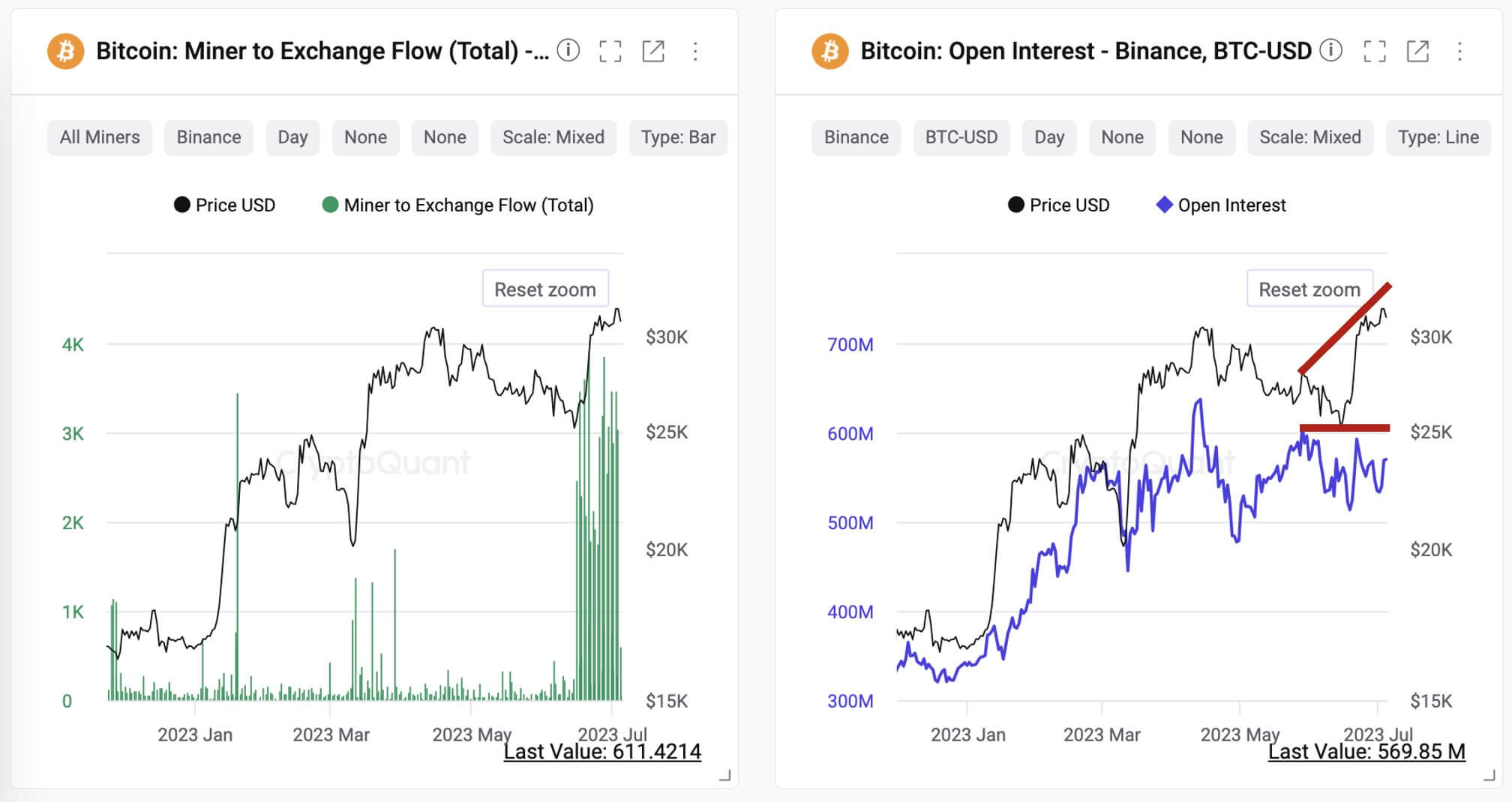

On July 4, CryptoQuant CEO Ki Younger Ju said miners despatched over 54,000 BTC to Binance up to now three weeks. Ju identified that there was “no important change in BTC-USD open curiosity, suggesting much less probability of filling collaterals to punt new lengthy positions.”

Ju added:

“Spot promoting appears extra seemingly.”

Of their lately launched operational updates, Bitcoin miners Marathon Digital, Cleanspark, and Hut 8 confirmed these transactions.

In a July 6 press statement, Marathon Digital stated it bought 700 BTC, representing 71.5%, of its mined 979 BTC in June for an undisclosed sum. Its rival, Hut 8, sold 217 BTC—100% of the Bitcoin it produced in Could and 70 Bitcoin produced in June—for $7.9 million.

In the meantime, Cleanspark sold 84% of the 491 BTC it mined in June for $11.2 million, based on a July 3 assertion.

These buying and selling actions recommend miners wished to capitalize on BTC’s current worth surge to safe income. In June, BTC principally traded above $25,000, peaking at $31,268 after a number of conventional monetary establishments, together with BlackRock and others, filed for Bitcoin ETFs.

The publish Bitcoin miners cash in on June price surge, selling thousands of BTC appeared first on CryptoSlate.

[ad_2]

Source link