[ad_1]

Ethereum price has been hovering round its highest stage since Could 2023 as buyers brace themselves for additional rate of interest hikes by world central banks this month. Ethereum, the biggest altcoin by market cap, has staged a powerful restoration previously few days, leaping by greater than 3% previously week and 64% within the yr to this point. On the time of writing, ETH was buying and selling at $1,953.70.

Elementary Evaluation

Ethereum value has been hovering above the essential stage of $1,920 for the previous few days amid elevated bullish sentiment within the crypto market by buyers. Bitcoin’s transient make out with the numerous $31,000 stage has seen the crypto market edge increased. Based on Coinmarketcap, the worldwide crypto market cap has elevated to $1.21 trillion, with the entire crypto market quantity leaping by 14.60% during the last day.

The crypto concern and greed index, which measures the present temper throughout the crypto market, signifies a shift in sentiment within the sector. Over the previous few days, the index has improved to a greed stage of 61, hinting at a continued bullish market correction.

The sudden curiosity within the cryptocurrency market by bigwigs resembling Constancy, BlackRock, Cathie Wooden, and Charles Schwab buoyed the crypto market in June. Wall Avenue heavyweights, Charles Schwab, Citadel Securities, and Constancy launched a crypto trade platform known as EDX Markets. Upon its launch, the high-profile crypto trade introduced the itemizing of solely 4 digital property, together with Bitcoin, Ethereum, Litecoin, and Bitcoin Money.

BlackRock not too long ago filed an software for Bitcoin EFT with the US Securities and Change Fee (SEC), a transfer that noticed crypto costs leap. Nonetheless, on Friday, The Wall Avenue Journal reported that the SEC informed Nasdaq and Cboe International Markets, each of which filed for the Bitcoin exchange-traded funds functions on behalf of varied establishments, that the filings weren’t sufficiently complete. After the report, BlackRock submitted a fresh application for a Bitcoin spot market ETF, which if profitable, would be the first Bitcoin spot ETF to win approval.

Focus is now on the worldwide central banks, per week after the Federal Reserve Chair, Jerome Powell, introduced that he expects a number of rate of interest hikes for the remainder of this yr. Different banks, together with the Financial institution of Japan, the European Central Financial institution, and the Financial institution of England, have additionally signaled their help for additional hikes.

Ethereum Value Outlook

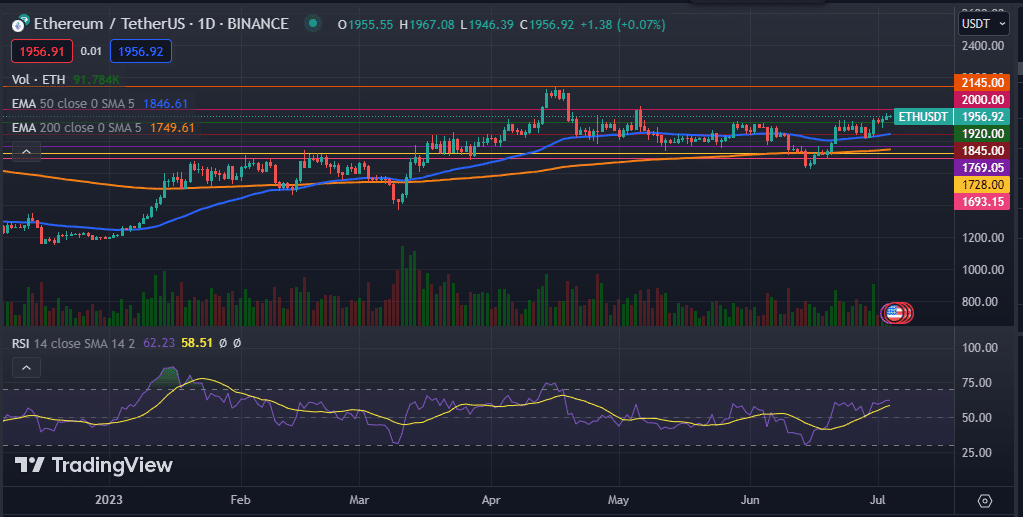

Ethereum value has been holding regular above the important thing $1,920 stage for the previous few days as bulls battle to push the value previous the vital resistance stage of $2,000. The altcoin has managed to maneuver above the 50-day and 200-day exponential shifting averages, whereas its Relative Energy Index (RSI) strikes above the impartial zone.

Due to this fact, regardless of the macroeconomic headwinds forward, the Ethereum value is prone to proceed rising as patrons goal the subsequent resistance at $2,000. Then again, a transfer under the 50-day EMA at $1,920 may push the value decrease to seek out help at $1,845.

[ad_2]

Source link