[ad_1]

The Gemini founders filed for the primary Bitcoin ETF with the US SEC ten years in the past, which was rejected for nearly the identical purpose the latest BlackRock and Constancy merchandise have been dismissed.

The necessity for a regulated Bitcoin product, together with an Trade Traded Fund (ETF), is undoubtedly mounting on america regulators as institutional buyers, led by BlackRock Inc (NYSE: BLK) with almost $10 trillion in Belongings Underneath Administration (AUM), pushes to enter the crypto business. With the $1 trillion crypto market estimated to overhaul that of valuable metals within the coming years, amid ballooning world inflation, the demand for well-structured digital property like Bitcoin and Ethereum can’t be ignored.

Because of this, the political divide between the Democrats and Republicans has elevated in terms of methods to control the nascent business. In keeping with the Biden administration, maybe a view shared by most Democrats in Congress, most digital property are unregulated securities, and buyers ought to put together for the digital greenback by means of FedNow quickly.

However, some politicians together with presidential aspirant Robert F Kennedy Jr, Bitcoin, and different crypto property are integral components of the monetary freedom that must be protected. Because of this, specialists forecast a fantastic rift in subsequent yr’s US presidential election on issues pertaining to crypto property.

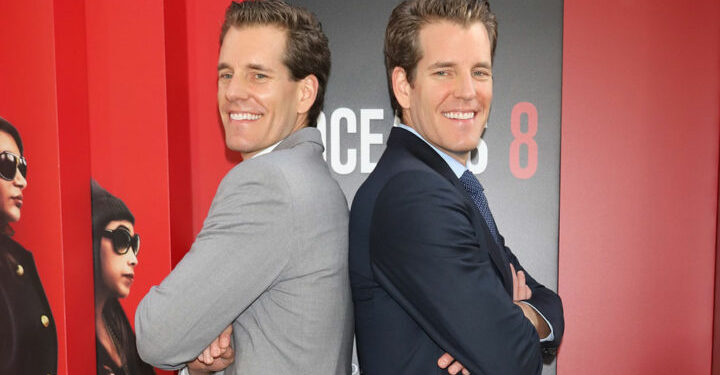

Winklevoss Brothers Criticize the SEC for Not Approving Protected Bitcoin ETF Merchandise

In keeping with Cameron Winklevoss, one of many Gemini exchanges co-founders, the SEC has pushed American crypto buyers to dangerous merchandise and companies like FTX for failing to approve safer avenues to entry the nascent crypto market. Notably, Gemini filed for a Bitcoin ETF ten years in the past however the SEC rejected the submitting.

In the present day marks 10 years since @tyler and I filed for the primary spot Bitcoin ETF. The @SECGov‘s refusal to approve these merchandise for a decade has been a whole and utter catastrophe for US buyers and demonstrates how the SEC is a failed regulator. Right here’s why:

-“protected”… pic.twitter.com/xmK1xo1iX8

— Cameron Winklevoss (@cameron) July 2, 2023

In keeping with the SEC, the Bitcoin market is closely managed by wash buying and selling and there are not any mechanisms to keep away from mass fraud. Nonetheless, Cameron famous that the SEC must stop overstepping its statutory powers in regulating the crypto business.

“Perhaps the SEC will mirror on its dismal document and as a substitute of overstepping its statutory energy and making an attempt to behave just like the gatekeeper of financial life, it should concentrate on fulfilling its mandate of investor safety,” he noted.

Notably, the crypto investor highlighted that some buyers have been pressured to enter the digital asset business by means of regulated and dangerous merchandise like Grayscale Bitcoin Belief (GBTC), which he known as poisonous. Price noting that Gemini and Digital Forex Group (DCG)- backed Genesis Buying and selling are underneath court docket supervision after failing to fulfill an affordable deal on defaulted loans.

In the meantime, the SEC has dismissed the latest Bitcoin ETF frenzy for missing readability and requested the respective companies to assessment their filings. The Bitcoin ETF frenzy considerably helped BTC value rebound from buying and selling beneath $25k to as excessive as $30.8k prior to now few weeks.

Let’s speak crypto, Metaverse, NFTs, CeDeFi, and Shares, and concentrate on multi-chain as the way forward for blockchain know-how.

Allow us to all WIN!

[ad_2]

Source link