[ad_1]

That is an opinion editorial by Shane Neagle, the editor-in-chief of “The Tokenist.”

Time and time once more, we see the mainstream media taking advantage of Bitcoin’s perceived exploit: vitality consumption. For the Bitcoin community, this path has grow to be all too acquainted.

Simply have a look at what occurred in Could 2021, when Elon Musk successfully “broke” bitcoin’s value as Tesla announced it could not settle for BTC as fee, citing environmental issues. The worth of a single bitcoin dropped by nearly $8,000 within the two hours following the announcement. There are numerous related circumstances as effectively.

However the takeaway is that this: It’s very clear that the notion of Bitcoin’s fundamentals goes far past the safety of the community, the soundness of the code and the asset’s restricted provide. Bitcoin’s vitality consumption performs a task, too. So huge of a task, that it considerably impacts not simply the value of bitcoin, however its regulatory framework as effectively. For higher or for worse, this actually can’t be argued.

However what if Bitcoin’s vitality consumption was really a very good factor? What if Bitcoin functioned as a “retailer of vitality” that gives a superior different to any financial system we’ve ever seen?

Luckily, the idea of an energy-backed forex just isn’t as radical or novel as individuals might imagine — it has been round for greater than a century. However the essential situations (i.e., the know-how) didn’t but exist to facilitate such a game-changing improvement for civilization.

That know-how now exists, nevertheless, and it’s known as Bitcoin. Let me clarify.

Cash And ‘Life Vitality’

The evolution of human civilization largely facilities upon the decision of 1 key query: How can we appraise the true worth of products and providers?

Extra particularly, how can we assess such worth in probably the most uniform and easy method potential?

Contemplate the period of ancient barter systems, when a uniform system of fiat forex had but to be conceived. Exchanging crops or livestock for providers was commonplace. Nonetheless, this method was fraught with inefficiencies, because it was closely reliant on the mutual coincidence of desires. Contemplate a fisherman trying to commerce his fish — however just for salt which he wanted to protect his future catch from spoiling. Any particular person trying to commerce for fish, should now have exactly what the fisherman wished: salt.

In such a situation, it’s straightforward to see how the precept of provide and demand is skewed.

Figuring out an equitable trade for distinctive, non-fungible gadgets poses a particular problem. How can we make sure that each events are duly rewarded for the vitality they’ve invested — their “life vitality” — in producing the services or products they’re promoting?

This idea of “life vitality” refers back to the time, effort and inventive vitality that people pour into their work. Each human has a finite time span that they convert into tangible, productive output — a measurable type of vitality.

However on this system of bartering, life vitality isn’t appropriately accounted for. Slightly, exterior components closely affect the worth of a services or products — ceaselessly to the detriment of the life vitality dedicated to its manufacturing.

Ideally, we want a system that permits for the buildup and storage of this expenditure of vitality — which we will seek advice from as “surplus vitality” — and its related worth.

The benefits right here go far past the person who expended such vitality. The metaphorical lifeblood of any financial system is this idea of “surplus vitality.” If this circulate is impeded or clots, it results in a much less vibrant, stagnant financial system. If it’s correctly saved and fluid, it may possibly result in innovation and breakthroughs which profit the society at giant.

If we do not set up correct mechanisms, capturing and storing surplus vitality or worth turns into unattainable.

Therefore, it turns into very important to measure this vitality output in probably the most streamlined method potential, to make sure truthful compensation for — and skill to capitalize on — the vitality expended. On this respect, a big landmark in civilization’s journey was the evolution from bartering to commodity cash, ultimately resulting in using transportable, interchangeable and standardized metallic cash.

A Historic Devaluation Of Life Vitality

The Roman Empire constructed itself on financial effectivity by minimizing cash friction. Its blood was the denarius currency, molded out of the restricted provide of treasured metals. The restricted nature of the denarius allowed for it to function a retailer of worth.

Concurrently, the denarius’ portability as a retailer of worth allowed it to unfold throughout each nook of the empire, simply transported and traded by numerous retailers. Consequently, the financial circulatory system overflowed with energy. Because the friction throughout the trade of products and providers was minimized, new specialised labor markets may kind, which elevated productiveness and innovation.

In financial phrases, all was good. The Roman civilization achieved a commodity forex which facilitated financial growth. Such a standardized forex, transportable and restricted because it was, saved and effectively captured Roman vitality into productiveness and financial progress.

Till it did not, by decree.

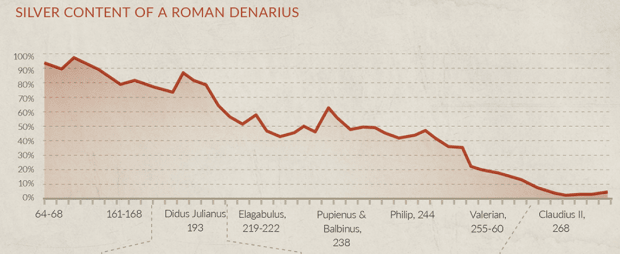

As every Roman emperor desired to expend extra vitality than the forex allowed, they began to erode the denarri’s retailer of worth.

The denarius remained transportable and fungible, but it started to falter in its means to precisely symbolize individuals’s life vitality outputs. The silver content material of every denarius grew to become smaller and smaller, eroding the forex’s means to take care of worth and, finally, buying energy.

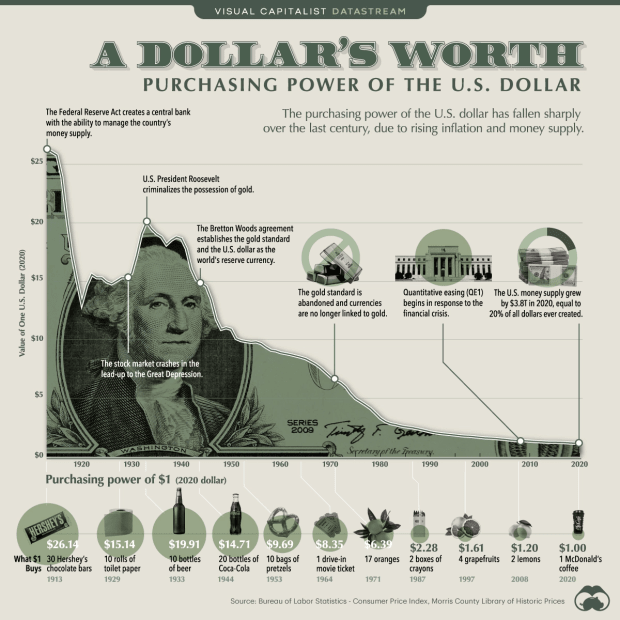

At present, we perceive this as inflation. With every forex debasement cycle, individuals misplaced confidence that their life’s vitality output was correctly measured, fairly similar to what’s happening today:

The US is in a peculiar historic place through which it can export domestic inflation due to the standing of the greenback as the worldwide reserve forex (GRC). Due to this fact, wages can continue to grow at an inflationary tempo. However, as debt ceilings have become debt ladders, nobody is aware of for positive for the way lengthy this will probably be sustainable.

And it’s positively not sustainable in lots of different international locations with double- and even triple-digit inflation charges.

Cash: What Wants To Be Mounted?

So, what patterns can we observe from our financial historical past?

First, to correctly measure life’s vitality outputs, the gauge must be fungible and standardized, facilitating a possible calculation of the worth of nonfungible items and providers. Second, the gauge must concurrently retailer worth and be transportable.

These baseline parts present individuals with a instrument to precisely remodel their restricted time and vitality — life vitality — right into a productive, well-compensated vitality output.

After we have a look at all fashionable fiat currencies, their shops of worth relaxation on shaky grounds. The issue is, central banks have changed emperors — however their decrees are not any much less disruptive.

At a elementary stage, the trade of funds between employers and staff is the trade of vitality. However neither employers nor staff management this compensatory vitality’s present(cy). That vitality’s present is offered by means of forex — and it’s totally managed by central banks.

Thus, it’s central banks that uniquely possess the authority to change that vitality present over time, echoing the observe of historical Roman emperors.

The most important affect on a forex’s retailer of worth is its provide and issuance schedule. Central banks and Roman emperors alike have had a bent to seriously change accessible provide, negatively impacting this attribute.

In flip, this negatively impacts individuals’s means to capitalize on their expended vitality.

Vitality Forex As New Milestone Know-how

From bartering and commodities, to metallic cash and fiat paper forex, historical past’s financial experiments have delivered actionable conclusions.

Alongside portability, sustaining the integrity of the forex’s retailer of worth is of the utmost significance. For this to be achievable, it should not depend on arbitrary decrees.

And that is exactly the revolution Satoshi Nakamoto introduced together with his Bitcoin white paper. The belief should be faraway from the centralized entities which have full management over financial methods — and the power for people to capitalize on their expended vitality by means of labor: “an digital fee system primarily based on cryptographic proof as a substitute of belief,” as Nakamoto put it.

The query then shifts to: How can we safe that new part of belief?

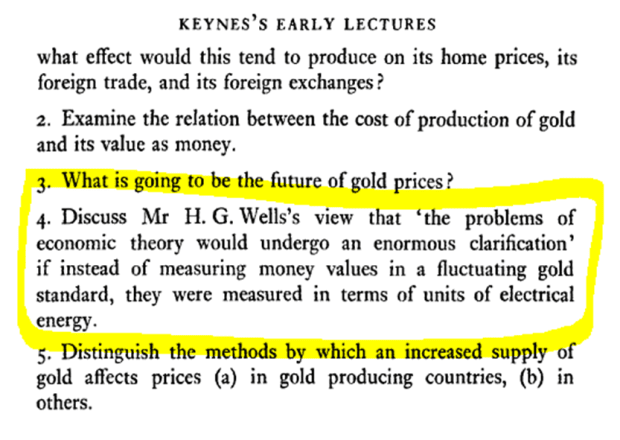

Previous intellectuals have argued for backing cash with items of vitality. Particularly, in John Maynard Keynes’ lectures of 1912 to 1913, which offered the mental framework for a method of measuring cash “when it comes to items {of electrical} vitality.”

Ever forward of the instances, American industrialist titan Henry Ford really proposed an vitality forex quickly after, in 1921. Ford’s “items of energy,” generated from the world’s largest energy plant, have been to unravel the problem of “the worldwide banking group to which we have now grown so accustomed that we predict there isn’t a different fascinating normal.”

Bitcoin: An Vitality-Secured System Of Vitality Transference

Within the case of Bitcoin, that new part of belief is secured by means of vitality.

Bitcoin just isn’t solely transportable however digitally transportable, complementing our digital period. It’s not merely scarce, however its shortage is outlined in an energy-agnostic means. This hyperlinks again to Ford’s dream of an energy-backed forex, however with a elementary distinction. Ford’s envisioned vitality forex, tied to the world’s largest energy plant, would have been prone to vulnerabilities related to centralization. In distinction, Bitcoin leverages vitality from any supply accessible.

The decentralized nature of computing energy creates a resilient and sturdy system. It’s by means of this vitality itself that the Bitcoin community secures this new part of belief — cryptographic proof.

On this mild, it’s no coincidence that Michael Saylor paints the imaginative and prescient of Bitcoin as the answer to the issue of how one can retailer vitality over time and throughout house.

Returning to one of many first factors talked about, the place Bitcoin’s notion goes past its personal fundamentals, two questions stay: How sturdy ought to Bitcoin be to exterior components? Are there any legit threats on the market?

Simply have a look at new know-how which is growing at breakneck speeds. Synthetic intelligence (AI) is anticipated to closely impression the finance world — from long-term investing and portfolio administration to shorter-term options trading. But with the event and mass integration of AI, actuality and phantasm will grow to be intertwined. Separating the 2 will grow to be an arduous job.

How will such important improvements impression Bitcoin?

Bitcoin is poised to endure such technological revolutions. The immutable nature of the blockchain permits for a level of verifiability which the event of AI will create a higher want for. But much more importantly, Bitcoin advocates see how Bitcoin represents one thing of a vocation, moderately than an asset merely for hypothesis and revenue. One of these “bigger than life” help will solely assist Bitcoin to endure life-changing improvements, political regime adjustments or some other existential “risk” that will come up sooner or later.

But there stays an ongoing absence of the correct framework on the subject of Bitcoin’s vitality consumption, as I’ve tried to articulate right here.

In line with a current ballot, for instance, 76% of investors need BTC to be extra “environmentally pleasant” — which misses the mark on the subject of the connection between Bitcoin’s vitality use (or, in different phrases, its technique of securing the community) and our means to successfully capitalize on the life vitality we commit.

With its distinctive means to retailer and switch vitality, the Bitcoin community fixes this dilemma.

Not solely is the community secured by vitality, however it has the potential to successfully allow people to correctly capitalize on using their life vitality. This implies Bitcoin has already ventured into the unprecedented territory of an vitality forex — not only for the good thing about the person, however of society at giant.

Historical past is right here and the journey has simply begun.

It is a visitor submit by Shane Neagle. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link