[ad_1]

The American arm of Binance is suspending greenback transactions after its cost companions indicated they’d pause US foreign money exercise with it, within the newest blow to the crypto change going through a lawsuit from American regulators.

Binance US mentioned in a press release on Friday morning that greenback dealing by way of banks and different cost companions can be paused as early as June 13, and from subsequent week it will begin to delist buying and selling pairs involving the US foreign money.

The corporate added it will transition to a crypto-only change.

The choice comes 4 days after the Securities and Change Fee filed a complete of 13 civil costs in opposition to Binance, related entities together with Binance US and chief government officer Changpeng Zhao.

Zhao mentioned on Thursday that Binance US had roughly $2bn in person funds “to one of the best of my information”.

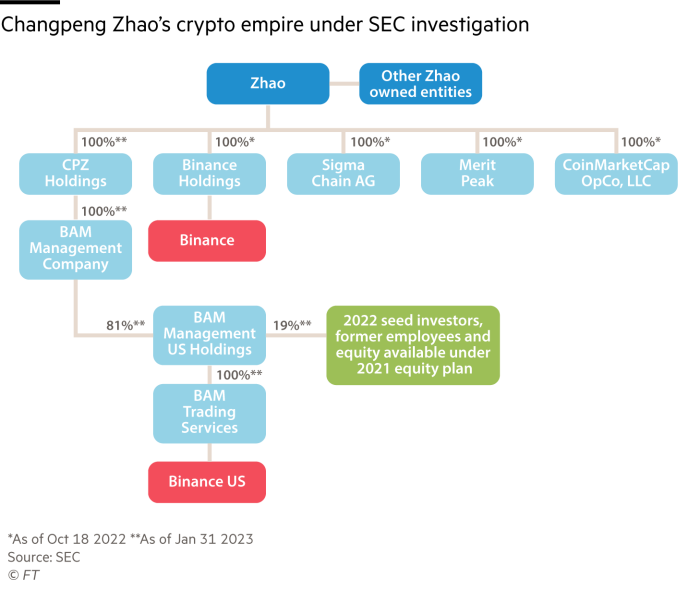

The SEC’s allegations in opposition to the crypto conglomerate embody working unregistered exchanges and misrepresenting buying and selling controls and oversight on the Binance US platform. The regulator added that Binance and Zhao had management of consumer belongings, and Zhao used a secretive offshore entity to ship greater than $16mn to a Binance-related entity to offer funds described as “crucial” to the operations of Binance US.

Binance.com, Binance’s offshore buying and selling platform, mentioned it was disillusioned and disheartened by the SEC’s motion, and added that whereas it took the regulator’s allegations critically, they “shouldn’t be the topic of an SEC enforcement motion”. Binance US known as the lawsuit “baseless”.

“Regardless of the baseless claims, and in gentle of the fee’s more and more aggressive ways, our cost and banking companions have signalled their intent to pause USD fiat channels as early as June 13 2023, that means our capacity to simply accept USD fiat deposits and course of USD fiat withdrawals will probably be impacted,” Binance US mentioned in its assertion.

It added that as a part of its crypto-only exercise it will proceed to help buying and selling by way of stablecoins, a sort of cryptocurrency designed to trace the value of conventional currencies.

The transfer is the newest indication that the Binance conglomerate is struggling to take care of energetic cost hyperlinks connecting cryptocurrencies to the standard monetary system. Filings by the SEC alleged that Benefit Peak and Sigma Chain — two offshore entities that the regulator claims served Binance and Zhao — each held accounts with Silvergate, and Benefit Peak additionally had one at Signature, two defunct crypto-friendly banks.

In February, the broader Binance group introduced it will droop US greenback funds on the change. It didn’t present a cause for the choice.

One month later, Paysafe, a web-based funds supplier, mentioned it will wind down companies to UK prospects of Binance. Earlier this month, Binance Australia ceased all Australian greenback buying and selling pairs, saying it was “working onerous to seek out an alternate supplier to proceed providing AUD deposits and withdrawals to our customers”.

[ad_2]

Source link