[ad_1]

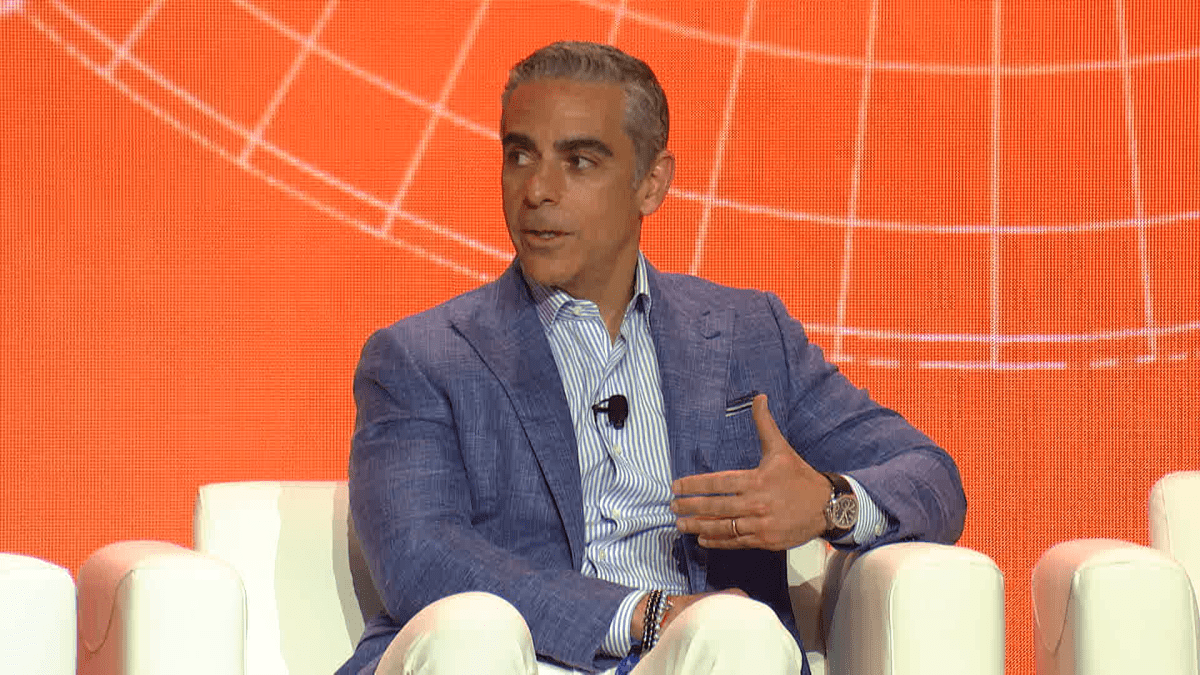

For almost 25 years, just about so long as on-line funds have been attainable, David Marcus has been trying to figure out how to perfect them.

Within the mid-’90s he based a telecom firm that supplied web entry together with phone service. In 2000, he launched Echovox, which he spun out into Zong in 2008 — a cellular platform that permit customers pay for issues on-line instantly by their cell phone payments. When this enterprise was acquired by PayPal in 2011, Marcus joined the digital funds big, turning into its president the following 12 months.

He’d learn the Bitcoin white paper shortly after it was printed, however “didn’t fall into the rabbit gap” at first, he recalled in an interview with Bitcoin Journal. Then, in 2012, Argentina ordered PayPal to cease all transactions that will ship cash in a foreign country because it grappled with currency inflation and a fiscal austerity effort, and the actual worth of this peer-to-peer digital money system began to resonate with him.

“We needed to (comply), we had been a regulated entity,” Marcus defined. “The day that occurred, bitcoin costs went up considerably and I used to be like, ‘Whoa.’ Like, that is one thing the place customers in a spot like Argentina are literally speeding into bitcoin as a method to transfer cash that they’ve earned — it’s their cash — in a manner that they noticed match. So, I felt that was a really eye-opening second for me by way of Bitcoin being an escape valve to sure behaviors that weren’t aligned with my views of self sovereignty, of cash … in order that was form of a turning level for me in 2013, the place it actually solidified my conviction.”

Shortly afterward, in Might 2013, he attended the Bitcoin 2013 conference in San Jose and, regardless of its comparatively small neighborhood, he was intrigued by the breakthrough Bitcoin had made in how digital funds might be facilitated.

“It was actually a handful, like two handfuls of individuals principally, it was so extremely early,” he stated. “I used to be fascinated by this normal concept that you simply transfer worth in a very self-sovereign manner with none intermediaries in any respect. And through that very same time interval, I bear in mind sending and receiving bitcoins, and I used to be organising wallets for buddies to indicate them what was attainable: ‘Look, that is me sending you cash and there’s nobody in between, proper?’ And I used to be actually fascinated by it.”

To The Greatest Of Our Skills

However Marcus was not but prepared to surrender on the potential for institutionalized but open funds for the web. In June 2014, he joined Meta (then Fb) as its vice chairman of messaging merchandise, growing the Fb Messenger cellular app. Marcus launched Messenger P2P Payments in 2015, which allowed customers to ship one another cash from their synced checking accounts by way of the app.

By mid-2019, Marcus had begun main Fb’s cryptocurrency undertaking, Libra, which was later renamed Diem earlier than being deserted altogether. Libra was almost instantly dismissed by Bitcoiners as providing nothing notably invaluable in comparison with different centralized digital forex initiatives. And Marcus discovered himself defending the undertaking earlier than the House Financial Services Committee in addition to the U.S. Senate’s banking committee, compelled to reply questions that had been typically extra broadly targeted on Meta’s historical past of invading consumer privateness.

However earlier than Libra settled on the permissioned, oligarchical node mannequin outlined in its white paper, Marcus had truly thought of leveraging the Lightning Community for his undertaking.

“I bear in mind assembly with Elizabeth Stark (CEO of Lightning Community improvement agency Lightning Labs) in early 2018 and attempting to determine whether or not Lightning was truly the best way to go, as a result of if there was a method to truly use Bitcoin, I actually needed to try this,” Marcus stated. “On the time, we thought, OK, possibly we are able to use Lightning after which construct a world-class pockets that we are able to embed throughout the entire Meta merchandise, WhatsApp and Messenger and others, after which allow folks to maneuver worth round.”

In the end, he determined the protocol wasn’t strong sufficient to meet Meta’s imaginative and prescient as a result of among the insufficiencies that it has but to beat, together with restricted nodes and liquidity.

“Even immediately, it will be difficult, and it will likely be difficult, to really get to billions of customers on the Lightning Community,” Marcus identified. “Even Layer 1 received’t have sufficient HTLCs (hash time locked contracts) to really try this. So, we’ll have to search out options as we get there. However our view was that it received’t scale… And as such, we got here to the conclusion that we have to go construct this proprietary expertise that we’ll then do no matter we are able to to decentralize to one of the best of our talents.”

Ultimately, Marcus’ means to decentralize a funds undertaking underneath Meta proved inadequate and he has since come to the belief that making an attempt to take action on some other community except for Bitcoin is an train in futility.

“We’ve constructed the unshakeable conviction at this level that the one blockchain and the one underlying property that may assist a very open protocol for funds on the web is Bitcoin and nothing else,” he stated.

In 2021, Marcus left Meta and the following 12 months he launched Lightspark to pursue that conviction.

The Motive Bitcoin And Lightning Are Higher

Lightspark builds software program and improvement instruments meant to make accessing the Lightning Community simpler, reminiscent of its software development kit to assist companies provide Lightning wallets to their clients and Lightspark Predict, which identifies the best-performing Lightning nodes and might route transactions to them.

Relatively than constructing a centralized platform to allow digital funds, Lightspark is targeted on constructing instruments to assist clients entry this current, decentralized one. And whereas Lightning Community adoption remains to be removed from rivaling the consumer base of one thing like PayPal, Marcus is optimistic about its potential to scale if firms like his are profitable.

“Lightning nonetheless has points, however I really feel very assured that we’re able to handle these points,” he stated. “You’ll see that for firms to combine on Lightning utilizing Lightspark providers, you don’t even want to fret about channels. You don’t want to fret about liquidity. You don’t want to fret about channel rebalancing and distributing liquidity. You don’t want to fret about what routes you’re going to make use of and which minimal payment or most payment you’re going to set. All of that complexity is being fully taken away from the equation of an organization deciding whether or not they’re going to implement Lightning for his or her customers or not.”

When requested if abstracting customers so distant from managing their very own liquidity, channel balances and routing might in a way recreate the problems with centralized, trusted monetary middlemen, Marcus responded with an analogy.

“Within the early days of the online, if you happen to needed a web site and also you needed to be on the web, you needed to go construct your individual server, discover a rack, put it in a rack, purchase a router, configure your router, get an E1 or a T1 line, plug that router into your E1 or T1 line after which preserve that entire factor on a regular basis, and it was like, OK, nobody does that,” he defined. “However the purpose Lightning and Bitcoin are higher is as a result of there are firms like Lightspark that may make issues simpler for mass market adoption, however if you’re in a random nation wherever, and also you simply have web connectivity, you possibly can run a node in your cellphone your self and be a participant on this community. And I believe that’s what makes it superb.”

And he went additional to underscore that his intention now could be to allow a sure form of Lightning adoption, relatively than roll out an answer that minimizes the necessity for unbiased contributors.

“We don’t count on everybody to make use of our software program,” he continued. “That will truly be a nasty factor, proper? We expect that everybody ought to run their very own factor and we’re going to cater to a sure phase of the market that’s going to are usually bigger, enterprise-types of consumers.”

Of all of the executives actively engaged on Bitcoin initiatives, Marcus in all probability has probably the most legacy expertise to tell him on what Bitcoin must succeed in addition to what it should keep away from so as to not fail. And, declaring that constructing on Lightning is the end result of his life’s work, he’s decided to succeed.

[ad_2]

Source link