Howdy and welcome to this week’s version of the FT’s Cryptofinance e-newsletter. This week we’re looking at one other “crypto use case” . . . buying fentanyl.

After final 12 months’s historic market crash and subsequent collapse of many high-profile corporations, the crypto business is in overdrive to persuade sceptics that there are helpful options to cryptocurrencies that demand mainstream adoption.

Critics of crypto’s use aren’t in need of ammunition, pointing to its hefty carbon footprint, lack of primary shopper safety, company ransomware and the financing of North Korea’s nuclear weapons programme.

This week one other goal emerged. Blockchain analytics agency Elliptic printed a examine linking cryptocurrencies with the unfold of fentanyl, a potent artificial opioid and the main reason for loss of life for 18- to 45-year-olds within the US.

In line with Elliptic, most fentanyl trafficked into the US is manufactured utilizing chemical elements imported from Chinese language suppliers, and 90 per cent of those suppliers settle for cryptocurrency funds.

Elliptic’s analysis staff obtained gives to provide giant portions of 1 explicit chemical ingredient which isn’t used to fabricate some other product, and is a managed substance in most nations. A “menu” of chemical substances offered to the Elliptic staff additionally included elements for methamphetamine and amphetamine.

“It’s exhausting to say how essential crypto is to this kind of exercise however the truth that such a big proportion of those suppliers settle for crypto suggests to me there’s a important demand to pay in crypto for a majority of these chemical substances,” Tom Robinson, Elliptic’s chief scientist and co-founder, advised me over the cellphone.

The fentanyl epidemic plaguing the US is tough to overstate. The illicit drug has changed legally prescribed painkillers as the primary reason for overdose within the nation, and the loss of life price is equal to 1 American overdosing each 5 minutes.

Alongside Covid-19, the fentanyl epidemic has pushed US life expectancy right down to 76.4 years, a low not seen for the previous 25 years.

Per Elliptic, the cryptocurrency wallets utilized by these corporations have obtained a complete sum of greater than $27mn, sufficient to buy elements that might produce fentanyl drugs with a avenue worth of roughly $54bn.

“The difficulty right here is {that a} comparatively small quantity of cryptocurrency should purchase sufficient chemical substances to supply huge quantities of fentanyl, and we all know that fentanyl is killing tens of millions of individuals . . . so the influence that crypto is doubtlessly having right here is excessive,” he added.

Furthermore, the variety of funds despatched to Chinese language suppliers of elements used to make fentanyl is skyrocketing. In line with Elliptic, only one cost utilizing crypto was made for these merchandise in January 2021. By final month, the determine was greater than 600.

Robinson advised me he believed crypto was an “inherently impartial expertise”, and that the identical traits that made it liable to illicit use additionally made it an amazing instrument for cross-border funds. “Extraordinarily highly effective applied sciences can be utilized for good and unhealthy, that’s simply the character of them.”

Nevertheless it provides one other dynamic to America’s more and more sophisticated relationship with crypto. On the one hand, markets regulators, the Division of Justice and the Treasury are attempting to stamp out illicit crypto exercise the place they will: enforcement, legal prices and sanctions.

But there are additionally loads of crypto supporters in Washington, together with Republican legislators Tom Emmer, Cynthia Lummis and Patrick McHenry. Democrats resembling Maxine Waters, a member of the US Home monetary companies committee, are much less satisfied.

Capitol Hill is a deeply divided place, because the protracted talks over the US debt ceiling have highlighted. It stays to be seen whether or not crypto’s hyperlink to America’s lethal opioid epidemic will change any minds.

What are your ideas on the function of cryptocurrencies within the fentanyl epidemic? As all the time please share your ideas with me through e mail at scott.chipolina@ft.com.

Weekly highlights

-

The run of unhealthy crypto information continues: UK losses to crypto fraud elevated by greater than 40 per cent up to now 12 months and surpassed £300mn for the primary time in historical past, in keeping with Britain’s fraud reporting company Motion Fraud. My colleague Siddharth Venkataramakrishnan has the story here.

-

Iosco, the umbrella group for international markets regulators, pushed nationwide regulators to interrupt up crypto corporations intertwined with intractable conflicts of curiosity. Following the collapse of Sam Bankman-Fried’s FTX and criticisms over the transparency of Binance’s company construction, Iosco has pushed crypto conflicts of curiosity into the highlight. My story with Laura Noonan here.

-

Terraform Labs co-founder and disgraced former crypto kingpin Do Kwon had his bail revoked in Montenegro. He was arrested earlier this year after the $40bn implosion of the terraUSD and luna tokens a 12 months in the past set off a world manhunt. He was arrested attempting to go away Montenegro on a false passport.

-

One other regulatory replace: the European Systemic Danger Board mentioned in a report that regulators within the EU ought to introduce limits on leveraged bets throughout crypto markets with the intention to restrict dangers posed to monetary stability within the broader financial system. The ESRB additionally mentioned the creation and design of good contracts — a foundational expertise in decentralised finance — needs to be overseen by regulators.

-

Following within the footsteps of El Salvador, Bhutan — the place the phrase “gross nationwide happiness” was first coined to rival gross home product — is investing in bitcoin mining. Druk Holding & Investments, the state-owned business holding firm, will begin pitching to traders to lift as much as half a billion {dollars} for a crypto mining enterprise. My colleague Benjamin Parkin in New Delhi has the story here.

Soundbite of the week: DeSantis backs bitcoin

Ron DeSantis, controversial governor of Florida and new presidential candidate, is on staff bitcoin.

Throughout a Twitter Areas session with Elon Musk this week (when it worked) the Republican many take into account the largest rival to Donald Trump, criticised the “present regime” for its stance on bitcoin.

“The present regime clearly has it out for bitcoin . . . and if it continues for an additional 4 years, they’ll in all probability find yourself killing it.”

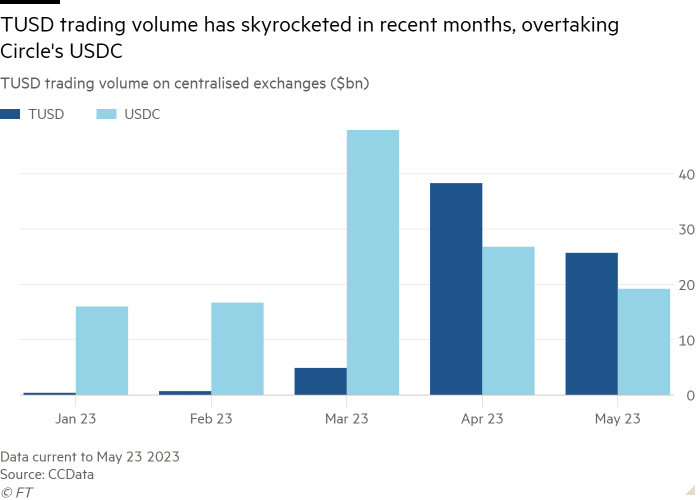

Information mining: TUSD enters the large leagues

The stablecoin market in 2023 has been dominated by two corporations, Tether and Circle, which have had very totally different fortunes.

Tether — the offshore, BVI-registered firm which points an eponymous token with roughly $80bn in circulating worth — has gripped the stablecoin market with roughly 60 per cent of market share.

Circle, the US firm with a bunch of state licences which points the USDC token, has been extra preoccupied with its token briefly de-pegging from the greenback and . . .*checks notes*: the banking business destabilising crypto markets.

However there could also be a brand new contender, TUSD, a stablecoin that first got here to market in 2018. Little or no is thought about it. It was launched by an organization referred to as TrustToken, which introduced in 2020 the possession of the stablecoin shall be shifting to an “Asia-based consortium.” TrustToken was rebranded as Archblock final September.

TUSD has a market cap of roughly $2bn, so small in contrast with Tether’s $83bn, however was lately boosted by Binance’s choice to incorporate it in a zero-fee buying and selling provide to prospects.

As of Might 23, TUSD turned the second-largest stablecoin by every day buying and selling quantity, outstripping Circle’s USDC, which has spent the previous few months ceding floor to opponents.

Cryptofinance is edited by Philip Stafford. Please ship any ideas and suggestions to cryptofinance@ft.com.