[ad_1]

On-chain knowledge exhibits a development within the present Bitcoin cycle that’s totally different from the sample adopted through the earlier epochs.

Extra Bitcoin Has Left Exchanges Throughout The Present Cycle So Far

In response to knowledge from the on-chain analytics agency Glassnode, the earlier cycles noticed the steadiness on exchanges register a internet enhance. The “balance on exchanges” right here refers back to the whole quantity of Bitcoin that’s presently sitting within the wallets of all centralized exchanges.

When the worth of this metric goes up, it means the traders are depositing a internet variety of cash to those platforms presently. Then again, a decline implies that withdrawals are occurring out there proper now.

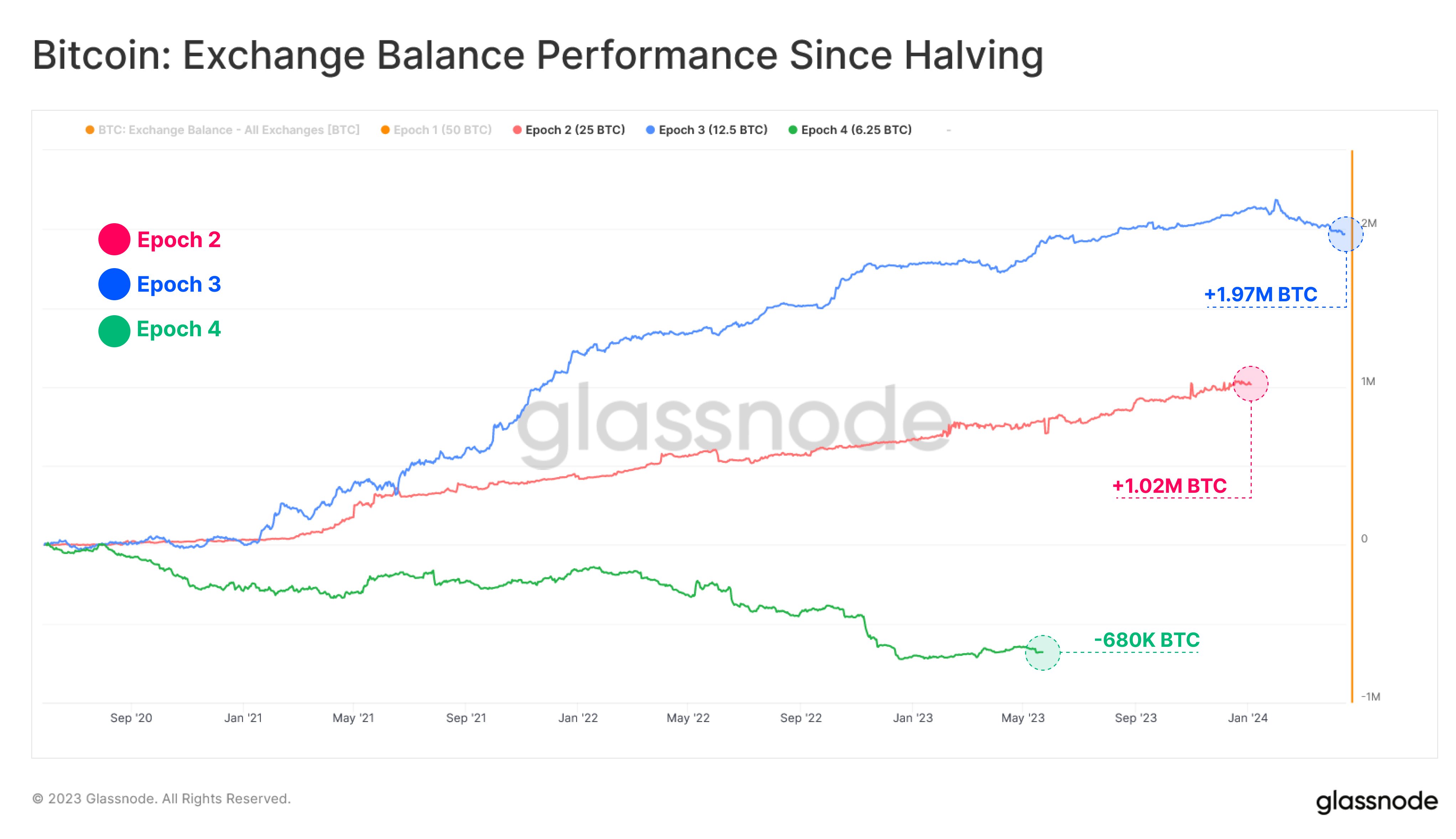

Here’s a chart that exhibits how the worth of this Bitcoin indicator has modified over the past two cycles and within the present epoch thus far:

Seems like the present cycle is exhibiting a distinct development than what was seen earlier than | Supply: Glassnode on Twitter

Glassnode has taken the “halvings” as the place to begin of every of the cycles or epochs right here. Halvings are periodic occasions the place the block rewards of the miners (which they obtain for fixing blocks on the community) are completely minimize in half. These happen roughly each 4 years.

These occasions have wide-reaching penalties for the economics of the cryptocurrency, because the manufacturing fee of the asset is constrained following them. This narrative behind the halvings can also be so robust that the peak of the bull runs has all the time occurred after them.

From the above graph, it’s seen that in epoch 2, that’s, the second cycle that the asset noticed, the Bitcoin steadiness on exchanges noticed a internet development of 1.02 million BTC. The subsequent cycle, epoch 3, noticed the metric rising by 1.97 million BTC, which is nearly double what the earlier cycle registered.

Observe that epoch 1 is absent right here as a result of it was the primary time ever that the asset was buying and selling, and therefore, BTC exchanges had been additionally solely a brand new existence. Because of this their provide may have solely gone up right here, because it beforehand didn’t exist in any respect.

Not like these cycles, nonetheless, the place the exchanges obtained a lot of internet inflows, the present epoch has seen traders taking out round 680,000 BTC from these platforms.

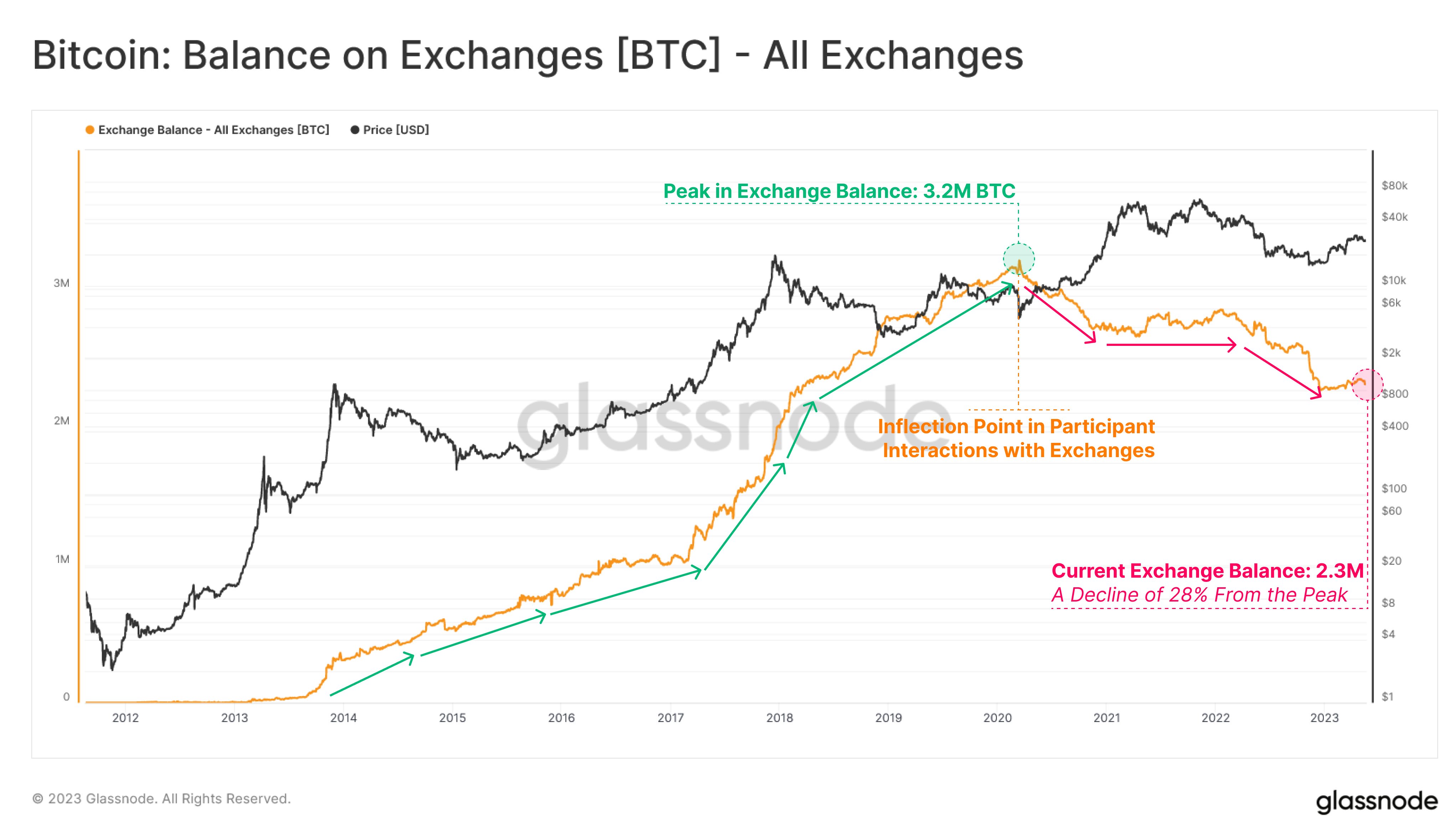

The beneath chart highlights how this decline within the Bitcoin steadiness on exchanges has taken place.

The worth of the metric appears to have been happening in current months | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin steadiness on exchanges hit a peak worth of three.2 million BTC simply earlier than the COVID crash befell again in March 2020.

“Retrospectively, the Covid Disaster gave the impression to be a catalyst for an inflection in participant interplay with exchanges, marking the inauguration of a macro decline in Trade Balances,” notes Glassnode.

At the moment, the indicator’s worth stands at 2.3 million BTC, which suggests a decline of 28% from the height. This cycle is out of the peculiar by way of this metric, nevertheless it’s value maintaining in thoughts that the epoch is but to finish.

Nonetheless, it’s nonetheless unlikely {that a} reversal may happen now to maintain the present cycle consistent with the sample from the earlier cycles, as the subsequent halving isn’t that far anymore (2024).

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,700, up 1% within the final week.

BTC has plunged previously day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link