[ad_1]

Coinbase has suffered an extra drop in buying and selling volumes though the value of bitcoin has rallied, elevating the stakes for the trade because it tries to fend off a probe from the US markets regulator whereas launching its personal authorized motion.

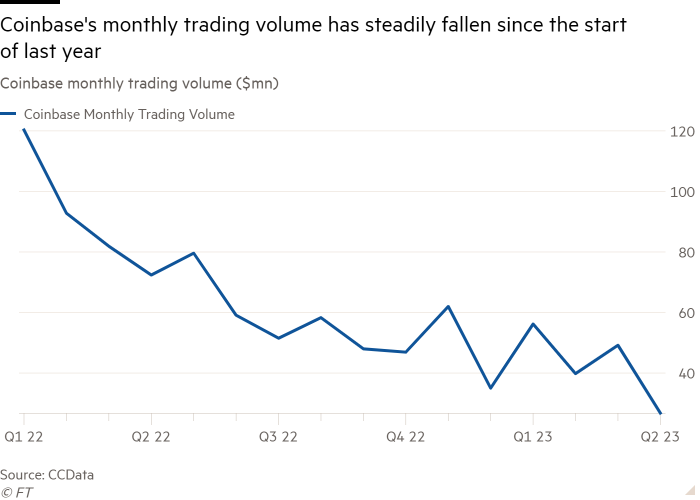

Month-to-month buying and selling quantity on the Nasdaq-listed group has fallen to $26.8bn thus far in April, on monitor for its lowest stage in 16 months, regardless of bitcoin surging and crypto merchants shifting funds away from US banks.

Bitcoin and ether, the 2 most actively-traded crypto tokens, have risen 64 per cent and 50 per cent, respectively, this yr as confidence has returned to a market badly shaken by a credit score disaster in 2022.

The decline in exercise on Coinbase deepens the squeeze on the San Francisco-based group, which depends on charges generated from buying and selling quantity for the majority of its revenues. Shares within the group have fallen by 17 per cent prior to now month as hopes have light for a rebound after a poor 2022.

Additionally it is the main target of a Securities and Change Fee investigation into attainable securities legal guidelines violation, and final month acquired a Wells discover from the SEC, a notification that the regulator was contemplating potential enforcement motion.

On Monday, Coinbase hit again with its personal lawsuit towards the SEC, asking a federal courtroom to power the regulator to offer clearer steerage on the principles governing the crypto market.

“Market sentiment has actually been affected by regulatory motion within the US,” mentioned Varun Paul, director of market infrastructure at blockchain platform Fireblocks, who beforehand spent 14 years on the Financial institution of England. “This authorized uncertainty is probably going adversely impacting crypto firms strolling a regulatory tightrope.”

US regulatory authorities have been cracking down on illicit crypto exercise this yr with a bunch of lawsuits and settlements, prompting fears within the business that crypto enterprise will both depart the US, transfer offshore or migrate to different buying and selling venues.

Coinbase administration has additionally refused to rule out leaving the USA. The trade reached a $100mn settlement with New York regulators for alleged anti cash laundering failures in January.

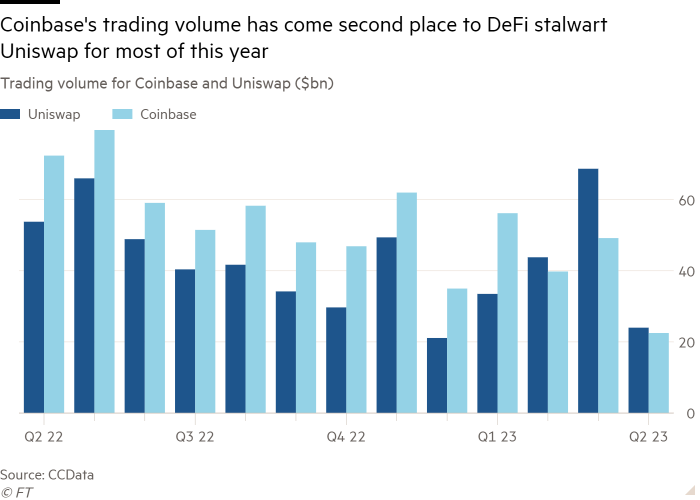

Coinbase’s buying and selling volumes prior to now three months have additionally been decrease than that of Uniswap, a little-known buying and selling community that permits customers to purchase and promote digital property instantly with one another and bypass intermediaries that may cost charges, like an trade.

Information analytics platform CCData discovered that Uniswap facilitated nearly $69bn in buying and selling quantity in March, compared to Coinbase’s $49bn.

On social media earlier this month, Coinbase chief govt Brian Armstrong mentioned the trade additionally used Uniswap to fulfil a few of its buyer companies. The DeFi platform has additionally facilitated extra buying and selling quantity than a number of Coinbase rivals, together with OKX and Kraken.

“I believe all US centralised exchanges are shedding or prone to lose to decentralised exchanges (or to international exchanges) as a result of US regulatory crackdown,” mentioned Nikolaos Panigirtzoglou, JPMorgan managing director centered on alternate options and digital property. “That is prone to be a gradual shifting background pattern relatively than an abrupt shift.”

[ad_2]

Source link

![Changing Ethereum [ETH] gas prices and its rippling impact: All you need to know](https://www.breakingaltcoinnews.com/wp-content/uploads/2023/05/AMBCrypto_An_image_showcases_a_gas_pump_with_the_Ethereum_logo__26fc6e41-0e55-44a4-9151-e793125b20b6-1000x600-75x75.png)