[ad_1]

Information reveals the Bitcoin sentiment had turned fairly bearish simply earlier than the asset’s worth had rebounded up from the $27,100 stage.

Bitcoin Recovers Shortly After FUD Takes Over Market

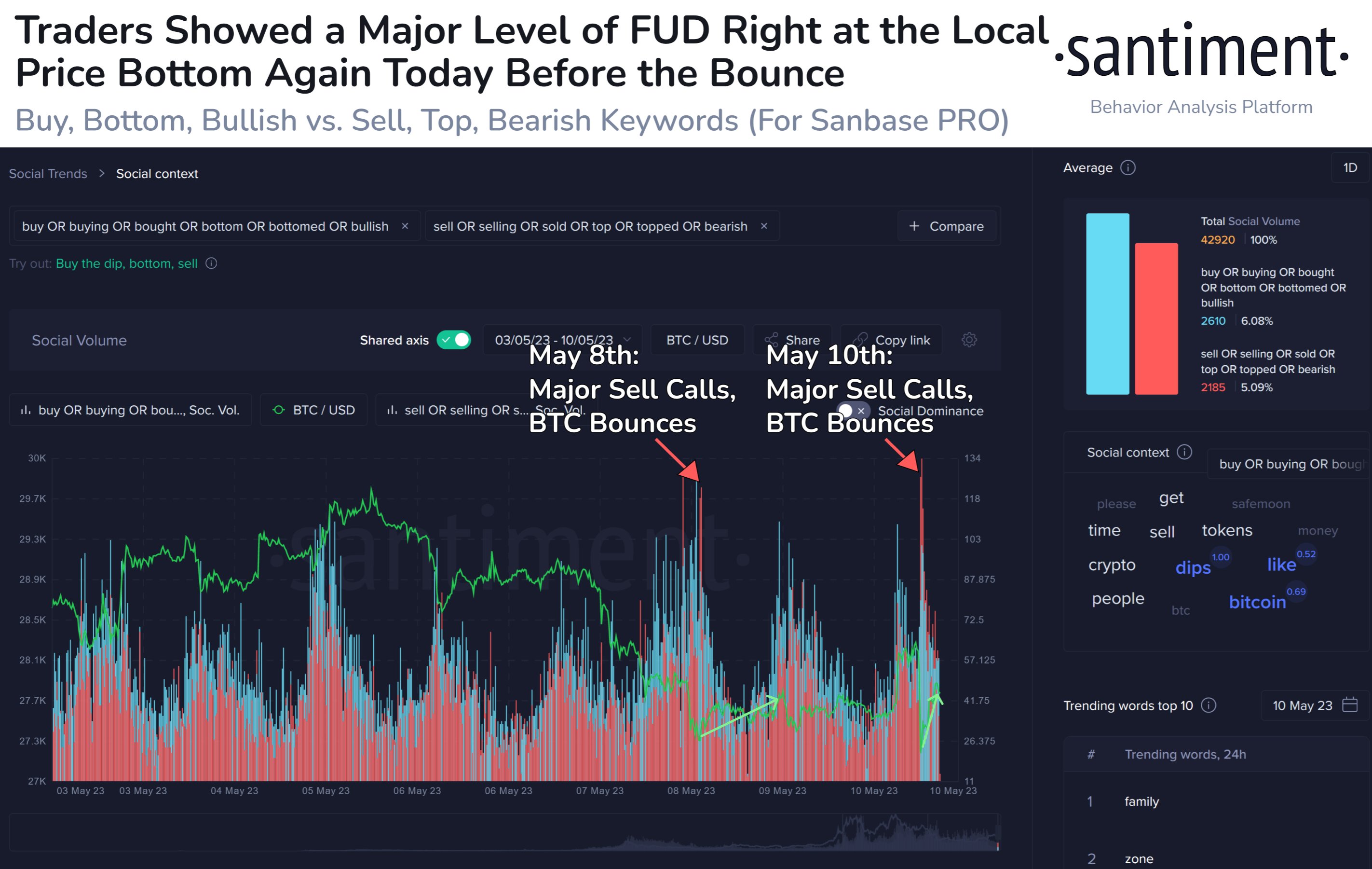

Based on information from the on-chain analytics agency Santiment, traders confirmed excessive ranges of concern across the time of the native backside through the previous day. The related indicator right here is the “social volume,” which measures the entire variety of social media textual content paperwork that point out a given subject like cryptocurrency or Bitcoin.

These social media textual content paperwork embody quite a lot of sources, like Reddit, Twitter, Telegram, and different boards. The social quantity solely tracks what number of such paperwork point out the time period at the very least as soon as. So because of this even when a put up accommodates the key phrase a number of instances, its contribution to the social quantity will nonetheless be just one unit.

The importance of the social quantity is that it tells us in regards to the quantity of dialogue that sure subjects are getting from social media individuals for the time being.

Within the context of the present subject, social media is used to know the diploma of the bearish and bullish sentiments available in the market. Here’s a chart that reveals the development in these social volumes for Bitcoin over the past week:

Appears just like the bearish sentiment has seen a pointy surge lately | Supply: Santiment on Twitter

To separate the social quantity for discussions that indicate a bullish mentality, phrases resembling “purchase, backside, bullish” have been chosen, whereas key phrases like “promote, high, bearish” are those chosen for pinpointing a bearish sentiment.

As displayed within the above graph, the Bitcoin social quantity for the bearish sentiment appears to have noticed a big spike through the previous day. This surge within the indicator had come after BTC had plunged from above $28,000 to round $27,100.

This implies that the BTC traders had turned very fearful throughout this panic selloff. The same stage of bearish sentiment was additionally noticed solely a few days again, because the chart highlights.

The flip in market mentality again then had additionally come following a decline (this time from the $29,000 mark to the low $27,000 ranges), and apparently, it had coincided with the native backside within the worth.

The spike this time has additionally occurred concurrently with the attainable native backside formation at $27,100, as the value of the cryptocurrency has recovered somewhat bit since then.

Traditionally, every time the market has held an opinion too unbalanced in any specific course, the value has tended to maneuver reverse to this opinion of the lots. Due to this, in instances when the market has seen giant quantities of greed, an area high has usually turn into extra possible.

Naturally, the identical goes for native bottoms as nicely, since they’ve normally fashioned when FUD has taken over the minds of the traders. The latest spike seems to have been an instance of this sample, and thus far, it appears to be like like the newest bearish sentiment spike can also be the identical.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,500, down 5% within the final week.

BTC appears to have been transferring sideways in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link